Debt

To get out of debt, you need to be intentional with your money. Reach your goals faster with our tools for evaluating your debt load, developing a repayment strategy, and staying committed.

Step #1: Get Your Budget In Order

To get out of debt, you first need to take a good look at your budget. You do this before you develop a debt repayment plan for two reasons:

- There needs to be a spending plan in place to avoid using credit

- It allows you to find extra room in your budget to put toward debt

Your goal is make sure your needs are met and find ways to free up income so that you’re able to spend more on debt repayment.

Budgeting

Ready to take control of your finances? See what steps to follow to develop a spending and saving plan and follow through on it.

Step #2: Stop Creating More Debt

This is why building a budget is a critical first step. Though it might be challenging, you’ll need to stick to your plan to avoid using credit. To help you stay the course, identify spending triggers and barriers to success.

Triggers

If you think you’ll be tempted to overspend, it’s good to know your triggers. Ask yourself:

- When am I tempted to use credit to buy something I can’t afford?

- What do I tell myself when I end up adding to my debt?

- In that moment, do I feel sad, mad, disappointed, frustrated, etc.?

It’s important to reflect and recognize what leads you to spend when you shouldn’t. Common triggers include retail therapy, boredom, leisure, and justification.

Barriers

Barriers are things that keep us from doing what we know we should do, and they get in the way of behavioral changes and success. Barriers can be difficult to identify and can be either easy or hard to overcome.

For example, if you’re trying to reduce spending on eating out, you’d probably aim to cook at home more. However, the physical act of preparing a meal can be enough to keep you from doing so; instead, you find yourself in the drive-thru.

To figure out your barriers, think of an action you want to do. For example, “I only want to go to the grocery store once a week.” Then ask yourself why you don’t do this to get down to the barrier that is stopping you from accomplishing this action.

Step #3: Make Your List

To develop your get-out-of-debt plan, you need to know where you stand with your debt. This requires gathering the details and putting together a list of everything you owe.

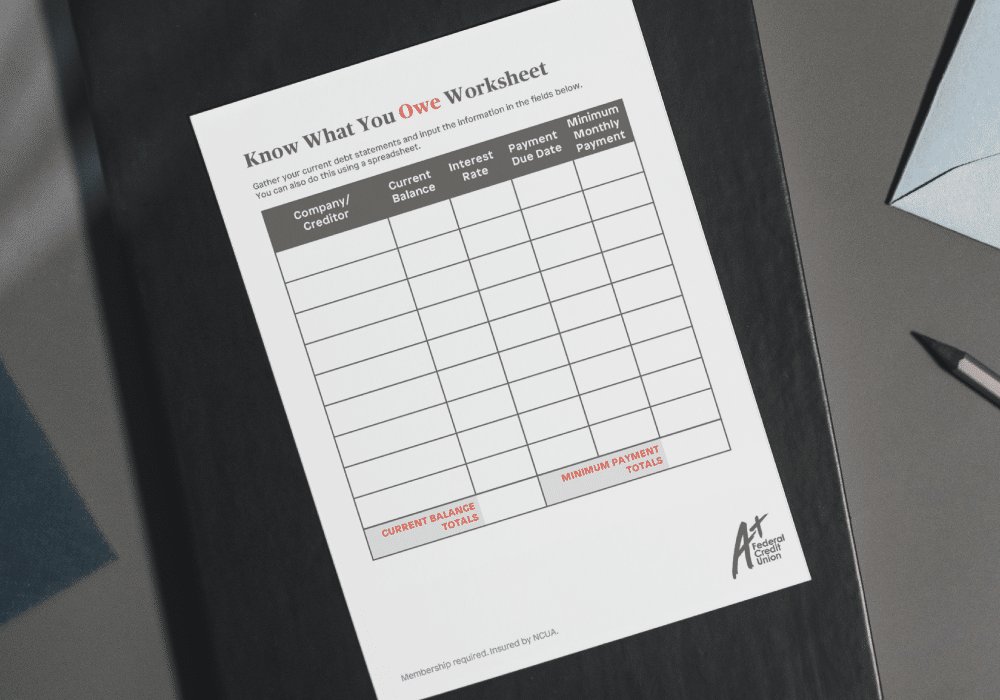

Know What You Owe

Use our free, fillable worksheet to organize your debts. Record the company/creditor, current balance, interest rate, minimum monthly payment, and payment due date for each debt.

Step #4: Make Your Plan & Set Goals

As you develop your plan, you’ll need to consider how much extra money you can afford to put towards your debt each month (above the minimum payments). Again, you’ll do this by reviewing your budget and finding ways to trim it so that you have extra money to put towards your debt.

Next comes the planning. In some cases, it’s beneficial to consider a multistep approach. For example, you might refinance your loans or consolidate your revolving debt before moving forward with the stack or snowball methods. Evaluate each option and pick the ones that work best for you.

Refinance

Refinancing involves replacing an existing loan with a new loan, ideally with a lower interest rate and/or lower monthly payment. While this isn’t a payment plan, refinancing debt can be a good strategy if you have debt with high interest rates.

Consolidation

When you consolidate, you take out one larger loan and use that loan to pay off multiple smaller loans. Instead of having numerous minimum payments to make, you’ll have one. In addition to reducing your monthly payments, it’s possible to reduce the interest and the time needed to pay off.

Stack Method

This debt repayment strategy is the one that typically costs the least over time because it focuses on paying the debt with the highest interest rate. To help further reduce interest costs, consider refinancing or negotiating for a lower rate.

Steps:

- Order your debts by interest rate (highest to lowest)

- Pay the minimums on all your debts

- Apply the extra money from your budget to the debt with the highest interest rate

- Continue to put extra funds toward that debt until it’s paid off

- Once the debt is paid off, apply that entire payment to the debt with the next highest interest rate

- Continue until all debts are paid off

Stack Method Example

| Debt | Balance | Interest Rate | Minimum Payment |

|---|---|---|---|

| Credit Card A | $1,000 | 17.9% | $15 + $100 |

| Credit Card B | $500 | 12.25% | $30 + $115 |

| Auto Loan | $17,500 | 6.0% | $350 + $145 |

| Student Loan | $23,000 | 5.2% | $250 + $495 |

Snowball Method

The snowball method involves paying off your debt in order from least to greatest balance. This can be the preferred method for some, as you might initially see debts paid off quicker. Set goals, consider consolidating revolving debt, try refinancing, or negotiate for lower rates for greater impact.

Steps:

- Order your debts by balance owed (lowest to highest)

- Pay the minimums on all your debts

- Apply the extra money from your budget to the debt with the lowest balance

- Continue to put extra funds toward that debt until it’s paid off

- Once the debt is paid off, apply that payment to the debt with the next lowest balance

- Continue until all debts are paid off

Snowball Method Example

| Debt | Balance | Interest Rate | Minimum Payment |

|---|---|---|---|

| Credit Card B | $500 | 12.25% | $30 + $100 |

| Credit Card A | $1,000 | 17.9% | $15 + $130 |

| Auto Loan | $17,500 | 6.0% | $350 + $145 |

| Student Loan | $23,000 | 5.2% | $250 + $495 |

Once you’ve picked your debt repayment strategy, set goals for yourself. When will you aim to pay your first debt off? When will you aim to pay 50% of your debt off? What will paying off your debt enable you to do? Think about what means the most to you and include those goals in your plan.

Free Debt Calculators

Use our calculators to easily compare loans, determine how much debt you have, and explore ways to pay down that debt.

Step #5: Put In The Work

You have your budget, list, and plan. Now, you’ll have to put in the work to reach your goals.

Tips:

- Know and recognize triggers

- Display your plan where you’ll see it every day – phone, refrigerator, desk, etc.

- Review your budget regularly and make changes as needed

- Continually look for ways to reduce expenses or increase income

- Dedicate windfalls (tax refunds, bonuses, etc.) to paying the debt you’re currently tackling

- Find someone to help hold you accountable

- Celebrate milestones

Rates & Resources

To keep you from having to do all the math, we’ve provided rates & calculators for all kinds of situations.

Related Articles

16 Months Of Financial Tips

Use these monthly financial tips to break down your top financial tasks and to-dos and get on the right path to being financially healthy.

What To Do If Your Income Is Reduced

When your income drops, every financial choice matters. From trimming spending to exploring safer borrowing options, these tips can help you navigate difficult times.

7 Tricks To Stay On Budget

Need help managing your finances? We’re sharing our tips to help you better plan, organize, and track your spending so you can stick to your budgeting plan.

Join The A+FCU Family

Joining is easy and comes not only with a wide variety of money-saving products tailored to fit your needs, but also exclusive member-only benefits.