Resources

If you’ve got any questions about A+FCU’s online banking services, we’ve got the answers you need. Check out our list of FAQs and resources to help you get the most out of A+ Online Banking.

How To Enroll

Get the most from your membership when you enroll in A+ Online Banking and download the A+ Mobile App using these easy steps:

- Enroll here or by tapping Enroll from the A+ Mobile App

- Fill out the form using the Primary account holder’s information

- Notate the Login ID and follow the prompts to finish the enrollment process

Customize Your A+ Online Banking

Use these tips and tricks to personalize your A+ Online Banking account so you can manage your finances more efficiently from the comfort of your home, office, or on the go.

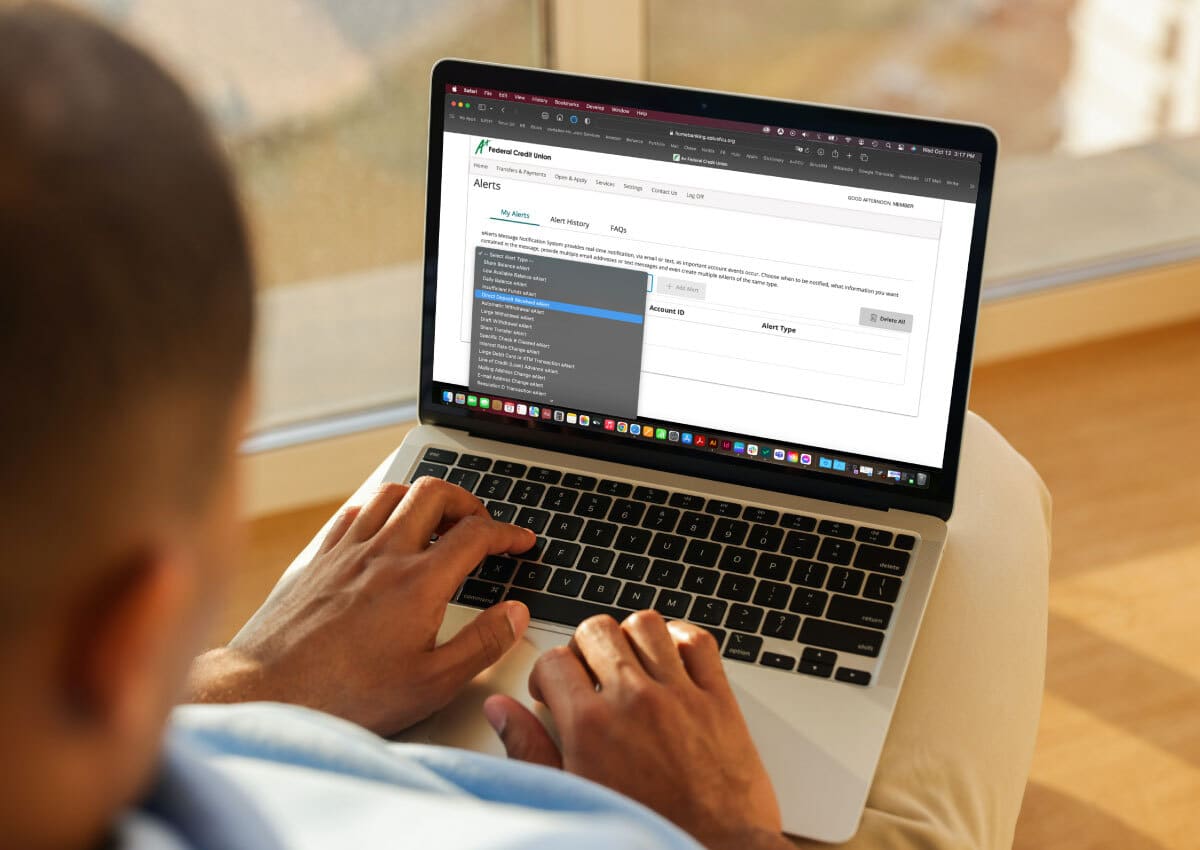

eAlerts

Looking for a way to keep track of your accounts? With eAlerts, or electronic alerts/notifications, you can stay up to date with your account and account activity.

You determine the type of alert you’ll receive when you set them up within A+ Online Banking or A+ Mobile App. These real-time notifications can be sent to one cell phone number and up to two email addresses.

Why Use Them?

With various types of eAlerts, you’re able to track spending, account balances, and more. This helps keep your account in good standing and avoid unnecessary fees.

For example, if you have a Low Balance eAlert set up to send you a text message when your checking account drops below $50, you’ll be able to transfer funds quickly to help cover future expenses and avoid overdraft fees.

You can even set up an eAlert to remind you when a loan payment is due or if a share certificate is renewing.

Most importantly, depending on the type of eAlert, you could find out about strange activity immediately assisting in monitoring and identifying potential fraud. A Large Withdrawal or Large Debit Card Transaction eAlert can notify you instantly to give you time to determine if there’s suspicious activity.

Choose The eAlerts You Want

With over 25 types of eAlerts, sign up for as many as you want! Customize your alert triggers based on your specifications and the types of products you have.

There are many eAlerts to choose from, including:

- Daily Balance – set up to receive once a day at the time you specify for whichever share or shares you choose

- Large Withdrawal – decide what threshold and share(s) you want to monitor and get notified when a withdrawal of that amount or greater is made

- Direct Deposit – use this eAlert to track when a direct deposit is made to the specified share(s)

- Low Balance – set up an eAlert to let you know when your share balance drops below a specified dollar amount

- Loan Payment Due – get notified when you have an upcoming loan payment

Frequently Asked Questions

eAlerts are notifications sent to you either by email and/or text message to let you know about certain transactions or events happening on your account. Each eAlert can be sent to multiple email addresses or cell phone numbers within minutes of the actual transaction.

Getting eAlerts set up is simple; follow these steps to start receiving notifications on your account.

- Log in to A+ Online Banking or the A+ Mobile App

- From the Menu select Settings > eAlerts

- Select Alert Type from the dropdown menu > Add Alert

- If you have multiple shares you can select which ones you want to apply the eAlert to

- Enter your email address and/or mobile phone

- Complete all the remaining required fields > Add Alert

- For text message eAlerts you’ll receive an Activation Code > Enter and Submit

Once you’ve set up an eAlert, you’ll begin receiving them. They’re processed and sent in real time. You won’t receive any eAlerts for transactions that occurred prior to when you set up the eAlert.

Click the edit button (pencil icon) next to the eAlert you would like to change. This will bring up a form that will allow you to edit all of the details for this specific eAlert. Click the Update Alert button once you’ve completed your changes.

If you update the phone number associated with the Mobile Phone field, you’ll have to enter an Activation Code. The Code will be sent to the phone number entered after submitting the update to the eAlert.

These eAlerts work at the share level and can be set to monitor either one individual share or all shares on the account.

Share Balance/Low Balance eAlert

Get notified when a transaction causes the selected share balance to fall below a pre-specified amount. You also choose how often you want to be notified (only the first time, each withdrawal, each transaction).

Low Available Balance eAlert

Get notified when a transaction causes the selected share’s available balance to fall below a pre-specified amount. You also choose how often you want to be notified (only the first time, each withdrawal, each transaction).

Daily Balance eAlert

Get notified of the appropriate balance(s) once daily at the time you specify.

Insufficient Funds eAlert (combines NSF, PlusPay, & Overdraw Transfer)

This mimics a situation in which each of the NSF, PlusPay, and Overdraw Transfer eAlerts have been created on the account. When this type is chosen, all three will be checked for and sent individually according to their descriptions above.

These eAlerts work at the share level and can be set to monitor either one individual share or all shares on the account.

A+ Online Banking Share Transaction eAlert

Get notified of any deposits, withdrawals, or any and all transactions conducted via A+ Online Banking.

Automatic Withdrawal eAlert

Get notified whenever an Automatic Withdrawal posts to the selected share(s).

Direct Deposit Received eAlert

Get notified of each Direct Deposit made to the selected share(s).

Draft Withdrawal eAlert

Get notified each time a draft withdrawal is completed on the share(s).

Large Debit Card or ATM Transaction eAlert

Get notified each time a transaction using that card (Credit/Debit Card, POS, or ATM), which equals or exceeds the pre-specified amount is completed.

Large Withdrawal eAlert

Get notified each time any withdrawal, which equals or exceeds the pre-specified amount, is completed on the share(s).

Share Transfer eAlert

Get notified each time a transfer transaction is completed on the share(s).

Specific Check # Cleared eAlert

A check number must be entered at the time of setup and you’ll be notified when it clears. This is a one-time eAlert and will be deleted from the active list once it’s sent.

These eAlerts work at the share level and can only be set to monitor one individual certificate.

Maturing Certificate eAlert

Select how many days in advance you want to be alerted to a certificate maturing and will receive notification accordingly. Can only be set to monitor one individual certificate.

These eAlerts work at the overall account level.

A+ Online Banking Access eAlert

Get notified any time your account is accessed via A+ Online Banking.

Mailing Address Change eAlert

Get notified any time a change is made to the Street, City, State, Zip Code, or Extra Address fields on your account.

Email Address Change eAlert

Get notified any time a change is made to either the Email Address or Alternate Email Address fields on your account.

Scheduled Transfer eAlert

Get notified each time a scheduled transfer completes successfully on your account.

Scheduled Transfer Failed eAlert

Get notified each time a scheduled transfer fails to complete on your account.

Loan or all loans on the account (will depend on the type of eAlert).

Interest Rate Change eAlert

Get notified whenever the interest rate is changed on the selected loan(s). Can be set to monitor either one individual loan or all loans on the account.

Loan Payment Due eAlert

Select how many days in advance you want to be alerted to an upcoming loan payment due date and receive notification accordingly. Can only be set to monitor one individual loan.

Loan Payment Made eAlert

Receive an eAlert each time a payment is made on the loan(s). Can be set to monitor either one individual loan or all loans on the account.

Loan Payment Change eAlert

Receive an eAlert whenever the payment amount on the loan is changed. Can be set to monitor either one individual loan or all loans on the account.

Loan Past Due eAlert

Receive an eAlert if your loan’s due date passes without a payment being made. You may receive this eAlert again if a payment is not made in a timely manner. Can only be set to monitor one individual loan.

There’s no limit to the number of eAlerts you can sign up for. You can sign up for multiple types of eAlerts as well as sign up multiple times for each type of eAlert.

For example, you can set up a Share Balance/Low Balance eAlert that notifies you any time your checking account balance drops below $200. You can also sign up for another Share Balance/Low Balance eAlert and have a message sent to your phone any time your account balance drops below $50.

Please note that not all eAlert types are available to everyone. The types that are available will depend on the types of products you have. For example, if you have no loans then the Loan Payment Due eAlert will not be offered to you.

Additionally, the process that triggers some eAlerts will not always work correctly for everyone. If there are any that will not be sent properly 100% of the time then it will be disabled.

Click the Delete button next to the eAlert you’d like to stop receiving. This will remove this eAlert from your account. To stop receiving all eAlerts you can simply click on Delete ALL.

On most eAlert setup screens there are two fields called Send eAlerts From and Send eAlerts Until. Enter the time range you would like your eAlerts to be sent.

If an eAlert is triggered outside of your chosen time range, your eAlert will be sent the following day.

The exception to this is the Daily Balance eAlert. For this eAlert type you need to choose a Notify Me At time to be notified of your balance(s) once a day during normal business hours. If you’d like to be notified of your balances multiple times a day, you can set up multiple Daily Balance eAlerts.

If you would like to receive all of your eAlerts at a specific time every day, simply set Send eAlerts From and Send eAlerts Until to the same time, making sure to choose a time during normal business hours.

Yes. All eAlerts sent for the last 90 days are kept. You can view them by using the Alert History section at the top of the eAlerts screen.

There are three different detail levels:

- Specific – Full Detail

- Moderate – Some Detail

- Generic – No Detail

Due to message length, you may receive an abbreviated version of a Moderate or Specific detail level eAlert when it is being sent to a mobile phone.

Let’s say you asked to be notified when a large withdrawal over $100 was made on your account:

Generic – No Detail

An eAlert has been triggered on your account. Please log in to your account online to view more detail.

Moderate – Some Detail

A Large Withdrawal eAlert has been triggered on your account. Please log in to your account online to view more detail.

Specific – Full Detail

A Large Withdrawal eAlert has been triggered on your account. You asked to be notified when a large withdrawal over $100 was made on your account:

Share 01 – Withdrawal Amount: 750.00, Withdrawal Time: 10:31

Post Date: 04/13/2022, Effective Date: 04/13/2022

New Balance: 980.00, New Available Balance: 975.00

This eAlert holds your default settings. When creating a new eAlert, your information is automatically entered. These default settings include Email Addresses, Mobile Phone, Notification Times, and Nickname.

Once you define your Default eAlert Settings, any future eAlerts you add will have the default values you specify pre-filled where appropriate. You can also overwrite these defaults on any eAlert during the setup process.

You can change the Default eAlert settings at any time by clicking the pencil icon to edit the eAlert or by selecting “Use these as default settings for new alerts” before setting up any new eAlerts or updates. Any changes made to the Default eAlert will not be automatically applied to existing eAlerts.

If you update the phone number associated with the Mobile Phone field, you’ll have to enter an Activation Code. The Code will be sent to the phone number entered after submitting the update to the eAlert.

An Account Nickname is optional and it’s a way to identify an account in the eAlerts you receive. If you have the same eAlerts set up on multiple accounts, an account nickname will allow you to know which one triggered an eAlert without logging in to A+ Online Banking immediately.

Important: We will not send any identifying information via email. You may NOT include your account number or user name in the account nickname.

Stay Safe With A+ Online Banking

Banking on the go from your phone or computer has made checking your accounts easier than ever. Keep your information safe by following these tips.

Do More With Online Banking

Online & Mobile Banking Enhancements

A+ Online Banking and the A+ Mobile App have been updated with a new look to bring you a better online experience! Your updated dashboard provides valuable, at-a-glance insights into your finances, plus allows an easier way to navigate.

Log in to A+ Online Banking and the A+ Mobile App to bank more efficiently with these improvements:

- Customize the Accounts dashboard view by selecting your most relevant accounts and the order in which they appear

- Easily locate features with fewer clicks – such as Bill Pay and Spending

- View your most recent transactions across all accounts and obtain additional details by selecting each transaction

- See upcoming loan payments, certificate maturity dates, Cash-Back-Checking year-to-date earnings, monthly credit score updates, and your Refer A Friend code

Additionally, you’ll notice a new background image within online banking that highlights our community. We’re proud to be voted the #1 credit union in Central Texas, and we want to recognize our local support. So, for the launch of our new dashboard, we’ve incorporated an image of Barton Creek here in Austin, Texas. Moving forward, we’ll periodically update these images to feature all of our local communities including: Austin, Bastrop, Buda, Cedar Park, Georgetown, Harker Heights, Hutto, Leander, Pflugerville, Round Rock, and San Marcos.

Check out our video for additional details about your new dashboard.

We’ve simplified the process of making your loan payments using funds from another financial institution with an easier-to-use loan payment page.

Log in to A+ Online Banking or the A+ Mobile App and select Transfers & Payments > Loan Payments/A+ Quick Pay > follow the prompts to make your selections.

It’s now easier than ever to set up external transfers between your A+FCU accounts and accounts at other financial institutions.

Log in to A+ Online Banking of the A+ Mobile App and from the Menu, select Transfers & Payments > Manage External Accounts. There you can choose from two options to add external accounts – the new Link via Instant Verification through our Plaid integration (if available) or Link via Micro-Deposits.

Instant Verification through our new Plaid integration allows you an easy and secure way to instantly authenticate external accounts. Follow the prompts to find your financial institution, enter your username and password of the external account, and complete the verification process.

You can also use the Plaid integration to link an external account using micro-deposits. The new integration with Plaid gives a couple new options that are easy and secure. After you select Link via Instant Verification, select Link with account numbers on the financial institution screen and follow the prompts to enter your information. This method typically takes one business day.

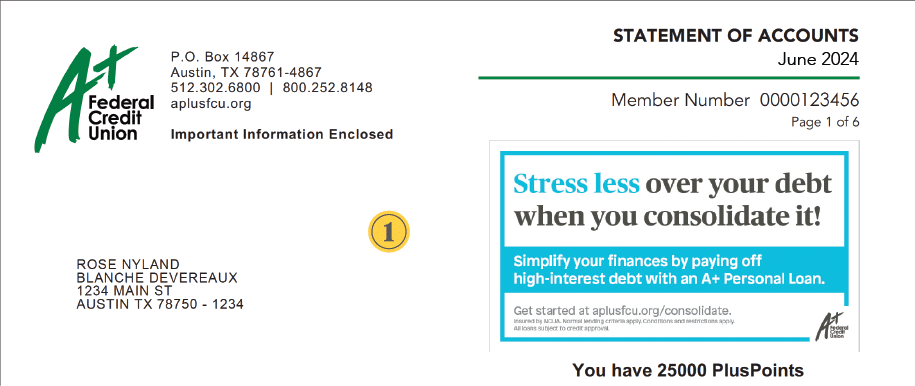

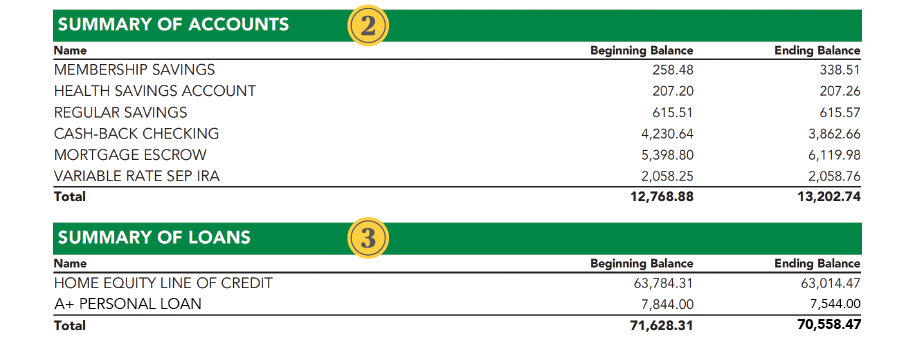

We’re excited to introduce our new and improved statement that incorporates an updated look and cleaner, more organized, easier-to-navigate account information.

Some highlights of your new member statement include:

- A new look for a more user-friendly experience

- A Summary of Accounts that shows a quick snapshot of your share accounts

- A Summary of Loans that includes all non-mortgage loan accounts, Home Equity Lines of Credit (HELOC), Commercial Real Estate, and Escrow Account information

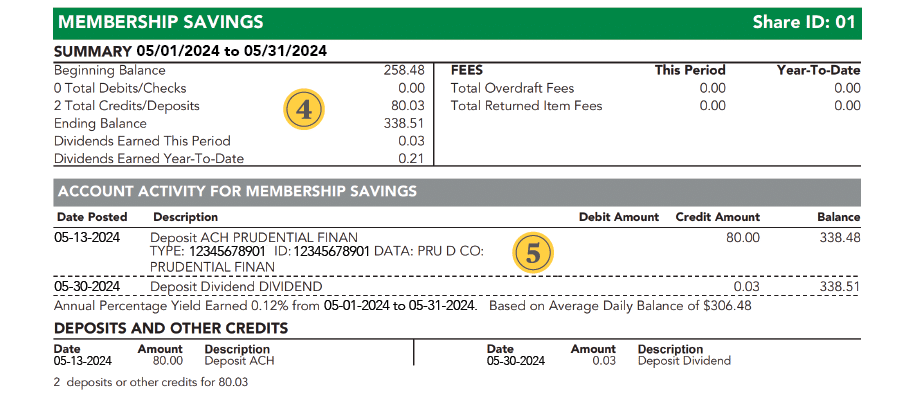

- Individual account summaries give an overview of information at the beginning of each share and loan type, including debits and credits, dividends, and fees during the statement cycle

- Account Activity for each share account and loan type showing all transactions that occurred during the statement cycle

One important change is that mortgage loan information will no longer be included in your regular Statement of Accounts. Instead you’ll be receiving a separate monthly statement for each mortgage loan type, with the exception of Home Equity Lines of Credit (HELOC) and Commercial Real Estate, whose details, along with Escrow Account information, will remain in the existing Statement of Accounts.

If you have any questions or if there are any discrepancies with the statement, call our Contact Center at 512.302.6800.

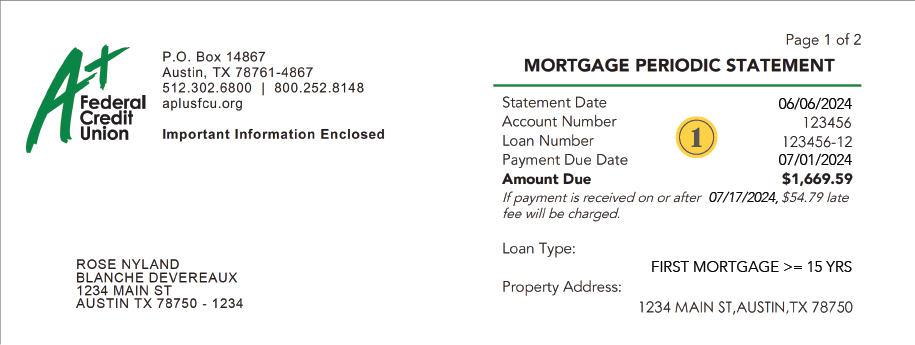

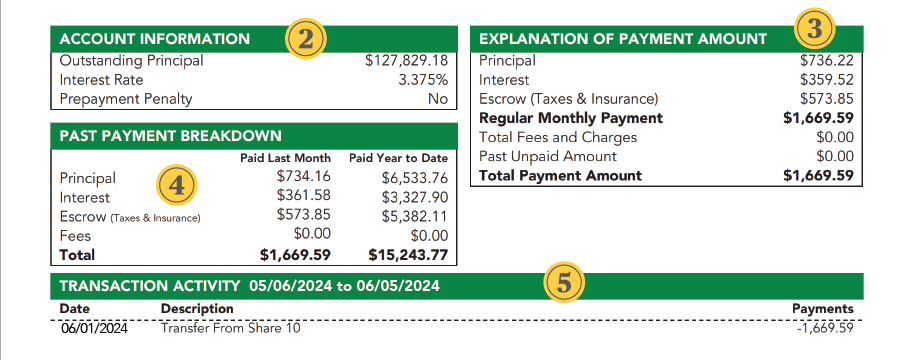

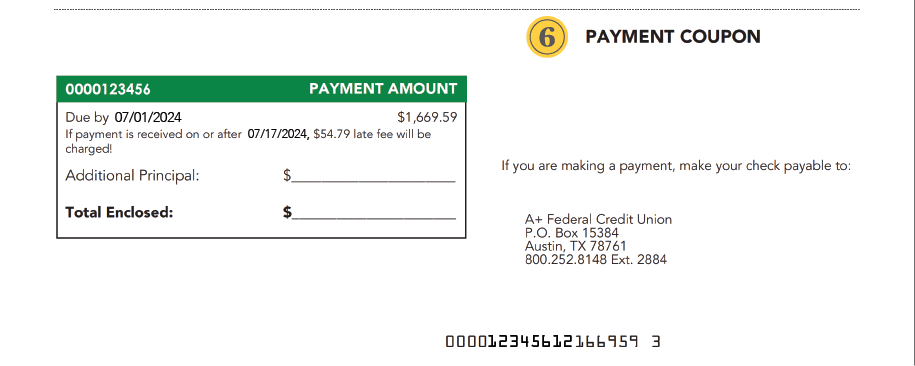

If you have your mortgage loan with A+FCU, you’ll now receive monthly mortgage statements for each mortgage loan type – with exception of Home Equity Lines of Credit (HELOC) and Commercial Real Estate – separate from your regular Statement of Accounts. This new monthly statement, which includes your payment coupon, provides account information in an organized, easy-to-navigate format.

Some highlights of your new mortgage statement include:

- A quick snapshot of loan information – including loan number, due date, and total amount due

- Account Information that shows your outstanding principal balance, interest rate, and if the loan contains a prepayment penalty

- An Explanation of Payment Amount so you can see a complete breakdown of the current monthly payment due and any fees that may be outstanding

- A Past Payment Breakdown that includes a breakdown of payments applied in the prior month along with year-to-date totals

- Transaction Activity to show all transactions that have occurred during the statement cycle

- A Payment Coupon should you decide to mail in your monthly mortgage payments. Please note: you’ll no longer receive a booklet of payment coupons and can discard your existing coupons.

Please be sure to review your new mortgage statement for accuracy. If you have any questions or if there are any discrepancies with the statement, contact the A+FCU Mortgage Servicing team at 800.252.8148, ext. 2884.

Resources

Make the most of your A+FCU membership with these resources to help you manage your accounts and better your finances.

Personal Finances

Financial health is a key part of overall wellness. Count on us to provide the knowledge and tools you need to make sense of your money, better your financial journey, and improve your peace of mind.

Safety & Security

Keeping your personal and account information safe can be challenging. Use our tools and tips to help protect yourself from fraud and identity theft.

Related Articles

How To Protect Personal Information Online: Tips From A Credit Union

Learn how to protect your personal information online with tips from A+FCU. Avoid scams, spot threats, and stay safe online.

16 Months Of Financial Tips

Use these monthly financial tips to break down your top financial tasks and to-dos and get on the right path to being financially healthy.

Avoid Tax-Related ID Theft This Tax Season

Identity thieves are hard at work year-round, but they’re especially active during tax season. Take preventative measures at tax time to minimize risk.

Get A+ Online Banking

Conveniently access your accounts, move money around, and even apply for loans from anywhere – anytime!