(Re)Building Credit

Credit is factored into many decisions, including loan approvals, housing applications, insurance rates, and employment opportunities. To obtain the most favorable outcomes, it’s important to understand the basics of credit scores and credit reports.

Credit Reports & Credit Scores

When it comes to building or rebuilding credit, it’s important to understand how credit reporting works along with how your credit score is derived.

What’s A Credit Report?

You can think of your credit report like a financial report card. It displays your borrowing history and summarizes how you manage credit.

The report includes:

- Personal information

- Credit account information and payment history

- Credit inquiries

- Bankruptcies

- Collections

Credit bureaus collect information from creditors and other sources then make them available for credit decisions. The three main credit bureaus – Equifax®, Experian™, and TransUnion® – each have a credit report for you. The data on each of those credit reports could be different for a variety of reasons, including when the information is reported and to which bureau it’s reported.

What’s A Credit Score?

If your credit report is like your financial report card, your credit score is like your financial GPA. It takes information from your credit report and calculates a score that predicts the likelihood of you paying back on time. Scores typically range from 300-850, with higher numbers indicating less risk to lenders.

Differences In Reports And Scores

A common misconception is that you only have one credit report and credit score when you actually have multiple credit reports and credit scores.

FICO® Scores

Developed by Fair Isaac Corporation, FICO scores are the most widely used credit scoring models and are calculated based on data that is on your credit report. There are different models, including specific versions developed for specific products, such as auto loans, mortgages, and credit cards.

Also, each credit reporting bureau has its own credit scoring models, similar to FICO. The thing to remember is the higher your credit score, the better. While lenders, not credit bureaus, determine loan approvals and rates, higher scores generally correlate with lower borrowing rates.

VantageScore®

A+FCU also uses VantageScore® for lending decisions. Founded by Experian, Equifax, and TransUnion, this scoring model gives consumers more credit access, helping lenders make more precise and equitable lending decisions.

Millions of consumers use this score to track their creditworthiness and monitor their credit health. With the ability to score approximately 96% of the U.S. adult population, VantageScore is a key driver of equitable access to mainstream credit.

Free Monthly Credit Score Updates

To help you understand and take control of your credit score, A+FCU members receive free access to their VantageScore® 4.0 – available in A+ Online Banking or the A+ Mobile App and updated each month.

Five Main Factors

While each credit scoring model has a unique formula and weighs elements differently, there are generally five main factors that are considered in credit score calculations.

The percentages and information shown here are based on the FICO scoring model. Though the percentages differ, these factors are similar for other models, including VantageScore.

Payment History is the largest factor in calculating a credit score.

- How late was your payment?

- How recently did it occur?

- How many late payments do you have?

- How much did you owe?

When evaluating payment history, the more severe, recent, and frequent the late payment, the greater the impact on your score.

One way to make a substantial impact on your score is by always making on-time payments.

Amount Owed looks at a few things:

- How much money you owe to lenders across all accounts

- Amount owed on specific types of accounts

- Number of accounts with a balance

- Credit utilization ratio on revolving accounts

- Remaining amount owed on installment loans

Your credit utilization ratio looks at how much you have borrowed on revolving debt, such as credit cards, compared to the amount available to you.

For example, if you have a $10,000 limit on your credit card and have a balance of $9,000, your credit utilization ratio would be 90%.

You want to keep your credit utilization ratio as low as possible – ideally, below 30%.

Lenders and credit scoring models look at past behavior as an indicator of future behavior. When evaluating credit history, they’re looking at three main things:

- Age of oldest account

- Average account age

- Age of specific types of accounts

If you’re new to credit, you’ll need at least six months of reported account activity and history to generate a FICO score. The more mature your accounts, the better.

New Credit considers how often you’re going out and applying for credit. It looks at:

- Number of new accounts

- Date you last opened a new account

- Recent requests for credit

It’s best to avoid applying for multiple loans within a short time frame, as it can indicate risk and cause concern for lenders. Rate shopping for auto, student, and home loans are the exception.

In fact, if you’re applying for multiple loans of the same credit type to get the best rate, FICO and other credit scoring models will consider that one inquiry if the applications/requests for credit fall within a certain window – typically 14 days.

The last factor, Types of Credit, looks at the different types of credit accounts you have, such as installment and revolving loans. Installment loans, like an auto loan or mortgage, have a set end date and number of payments. Revolving loans, such as a credit card or line of credit, have no set end date or monthly payment.

Keep in mind, you don’t need to have one of each type of loan and not all credit is created equal. Payday loans and retail cards, for example, have high interest rates and can enable spending and higher balances.

As your borrowing needs grow, there’s simply an opportunity to show you can manage diverse types of credit responsibly. Credit mix becomes especially important when you don’t have well-established credit history.

Access Your Credit Report

To ensure accurate reporting and to protect against identity theft, aim to obtain your credit report at least once a year. It’s free to do so and doesn’t impact your credit score.

Work With An Expert

BALANCE, our partner in financial education, can help with free, confidential one-on-one coaching. Request a credit report review or information on how to improve credit.

Identifying & Correcting Credit Errors

Errors on your credit report are more common than you might think. A 2021 Consumer Report Survey found that more than one-third of participants found errors on their credit reports.

Errors can negatively impact your credit score and, depending on the type and severity, can prevent you from getting credit. In some cases, errors could also be a sign of fraud or identity theft.

Three Main Types Of Errors

| Account-Related | Derogatory Mark | Personal Information |

|---|---|---|

| Credit limit or balance | Collections | Name |

| Account status (opened or closed) |

Bankruptcy | Address |

| Payment history | Foreclosure | Birthdate |

| Account holder status (joint, owner, authorized user) |

Repossessions | Social Security number |

| Unknown accounts | Employer |

Fixing Errors

According to the Fair Credit Reporting Act, you have the right to know what’s in your credit file, dispute incomplete or inaccurate information, and limit “prescreened” credit and insurance offers.

Consumer reporting agencies are required to correct or delete inaccurate, incomplete, or unverifiable information and may not report outdated negative information.

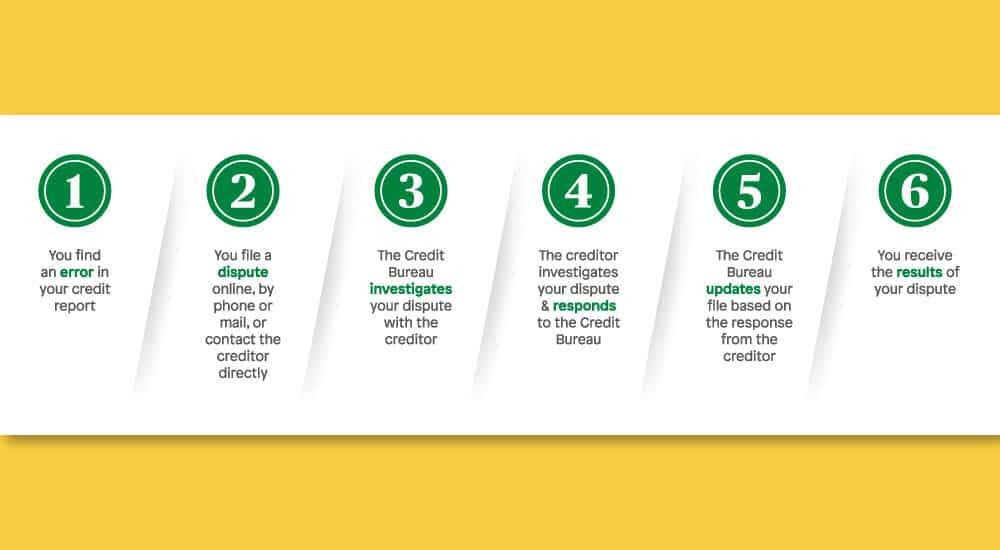

Steps To Take

1. Get Your Credit Report

To fix errors on your credit reports, you first need to obtain your credit report. You have the right to access your credit report from each of the three reporting bureaus annually for free. You can do so by visiting the government-sponsored site, annualcreditreport.com.

2. Go Over It Carefully

When you get your report, review it carefully for possible errors. If you find inaccurate or unrecognized information, make note of it.

3. File Disputes For Each Claim

If there are errors, you need to file a dispute for each claim. Be sure to detail the issue, provide supporting documentation, and keep record of everything said or sent. If you file a dispute by mail, use the Federal Trade Commission’s sample letter to get started.

4. Wait For The Results

The credit bureau has 30 days to investigate your dispute. If an error is found, it must inform the other nationwide bureaus so they can correct the error too. All results will be sent in writing, and you’ll be informed if additional information is needed.

Equifax®

File a dispute online by clicking the button below or you can dispute via phone or mail.

Phone Number: 866.349.5191

Mail Letter & Documents To:

Equifax Information Services LLC

P.O. Box 740256

Atlanta, GA 30348

Dispute Cost

Free

Experian™

File a dispute online by clicking the button below or you can dispute via phone or mail.

Phone Number: 888.397.3742

Mail Letter & Form To:

Experian

P.O. Box 4500

Allen, TX 75013

Dispute Cost

Free

TransUnion®

File a dispute online by clicking the button below or you can dispute via phone or mail.

Phone Number: 833.395.6941

Mail Letter & Documents To:

TransUnion Consumer Solutions

P.O. Box 2000

Chester, PA 19016-2000

Dispute Cost

Free

Four Things To Know About Credit

In addition to knowing more about credit reports and credit scores, these four tips can help you better understand how to build and improve your credit.

Credit Determines Borrowing Costs

Not only is your credit score factored into approval decisions, lenders also use it to determine your cost to borrow, also known as your interest rate.

Higher credit scores indicate you’re more likely to pay obligations on time, so your cost of borrowing is lower. Lower credit scores indicate you’re at a higher risk of not repaying on time, so your cost of borrowing is higher.

Your credit report and score aren’t the only things that matter when a lending decision is made. Other considerations include:

- Stability: how long have you worked for your employer? How long have you resided in your home?

- Comparable debt: have you borrowed this much before? Can you handle this type of debt?

- Escalating debt: would you be taking on too much debt too soon?

- Relationship: how long have you been a member? What’s your banking history like?

- Capacity ratios: debt-to-income, payment-to-income, revolving debt, disposable income

- Collateral: does a property or other asset secure the loan?

Impact Of Credit Score

| Low Credit Score | High Credit Score | |

|---|---|---|

| Balance | $10,000 | $10,000 |

| Interest Rate | 18% | 9% |

| Payment | Minimum | Minimum |

| Payoff Time | 14.8 years | 11.7 years |

| Interest Paid | $5,916 | $2,278 |

You Need Credit To Build Credit

To build or rebuild credit, you need to have at least one credit account, which you can use to show you can manage credit responsibly.

Things to remember:

- Don’t borrow just to borrow. There should always be a purpose.

- Make your payments on time. This will help build your credit history.

- If using revolving credit, pay your balance in full every month. You don’t need to carry a balance to build credit.

- Maintain your current accounts and limit requests for additional accounts. Keep in mind, every hard credit inquiry drops your credit scores, at least initially.

The Better Your Score, The Harder You Fall

When applicants with higher credit scores apply for credit, they’re generally considered low-risk borrowers and qualify for lower interest rates. This is because they’ve shown a pattern of positive credit behavior by making on-time payments, keeping their balances low, having a longer credit history, not opening new credit accounts often, and having a good credit mix.

If someone with this type of behavior suddenly makes a late payment, it’s highly unusual. As a result, their credit score will have a more significant drop.

For example, Jane has a 780 credit score and no late payments. John has a 680 credit score, a 90-day delinquency from two years ago, and a 30-day delinquency from one year ago. They each make a payment that’s 30 days late and is reported to the credit bureaus. While Jane’s score could drop 90-110 points, John’s may only drop 60-80 points.

Negative Information Ages Off

The reporting of negative information on a credit report is limited to a set time. Additionally, the older the negative item, the less impact it has on your score.

Breakdown Of Approximate Credit Weight:

- 40% weight = current to past 12 months

- 30% weight = 13-24 months

- 20% weight = 25-36 months

- 10% weight = 37+ months

| Type | Duration On Credit Report |

|---|---|

| Late Payments | 7 years |

| Completed Chapter 13 Bankruptcy | 7 years |

| Chapter 7 Bankruptcy | 10 years |

| Foreclosures/Repossessions | 7 years |

| Collections | 7 years (can vary) |

Resources

Get on the path to financial success with these resources.

Related Articles

16 Months Of Financial Tips

Use these monthly financial tips to break down your top financial tasks and to-dos and get on the right path to being financially healthy.

Lifestyle Creep: What Is It & How Can You Avoid It

Lifestyle creep quietly drains the progress from your rising income. Learn how to avoid it and take control of your finances with these tips.

11 Ways To Live More Energy-Efficient

Living green can include making big or small changes to your lifestyle. Save the environment – and your wallet – with these tips to live more energy-efficient.

Join The A+FCU Family

Joining is easy and comes not only with a wide variety of money-saving products tailored to fit your needs, but also exclusive member-only benefits.