Creative Ways To Cut The Cost Of Homeowners Insurance

The rising cost of homeowners insurance can feel overwhelming – here are some tips to help stay on budget.

Protecting your property is essential, but the rising cost of insurance can feel overwhelming. As risks increase and wages remain stagnant, many homeowners experience financial strain when it’s time to renew their policies.

If your recent premium hike has left you with sticker shock, it’s time to take action. You don’t have to accept those higher rates passively. Here are eight strategies to help you regain control.

8 Tips To Reduce Your Monthly Premiums

Up Your Deductible

Your deductible and premium work inversely, so one of the best ways to reduce your monthly cost is by opting for a higher deductible. You’ll have to pay more in the unlikely event your property is damaged, but you can use the premium savings to beef up your emergency fund.

Protect Your Possessions

Adding a security system to your home is a great way to safeguard your loved ones and belongings. It can also help reduce your monthly homeowners insurance premiums. Many insurers offer significant discounts for protected homes, so ask your agent about potential savings.

Watch Your Neighborhood

Getting involved in your neighborhood watch is not only a fantastic way to connect with your neighbors, but it can also help reduce your insurance premiums. Some insurers provide discounts for members, so be sure to check with your agent before the next meeting.

Consider Your Pup Carefully

It may not seem fair, but the type of dog you have can affect your homeowners insurance premium. Certain breeds, like Staffordshire Terriers and Akitas, may lead to higher rates. If you already have a four-legged friend you love, you might accept the added cost, but if you’re considering getting one of these breeds, you should ask about any potential breed-specific surcharges.

Upgrade Your Infrastructure

Strengthening your home’s infrastructure to withstand natural disasters can greatly reduce the risk of severe damage. If you’re contemplating a major upgrade or home improvement, reach out to your insurance agent about possible discounts for these protective measures.

Improve Your Credit Score

Homeowners insurance providers may consider credit scores when determining premiums. They may also review those scores from time to time – beefing up your credit score could lead to lower monthly premiums.

Bundle Your Policies

Insurance companies frequently offer substantial discounts for bundling policies, allowing you to save on multiple coverages. Combining your auto and homeowners insurance under one provider could result in significant savings on both your home and car.

Shop Around Every Year

Homeowners insurance isn’t something you can simply set and forget; it’s important to review your coverage periodically. If property values have increased since you first purchased your policy, you may need extra coverage to stay fully protected. Additionally, shopping around could help you save money since every company uses its own underwriting criteria.

Summary

While homeowners insurance is a necessary expense, you don’t need to pay more than needed. From shopping around regularly to installing a sophisticated home security system, there are things you can do to reduce the high cost of protecting your property and possessions.

Copyright BALANCE

Your Guidance To Insurance

Your personal property is worth protecting. Learn more about the different types of insurance you need and what steps to take.

Related Articles

How Does Paying Back A HELOC Work?

Understand HELOC repayment, what happens after payoff, and key Texas regulations before borrowing against your home’s equity.

How Much Equity Do You Need To Refinance?

Learn how much equity is needed to refinance, explore loan options, and familiarize yourself with key requirements to make the best mortgage refinancing decision.

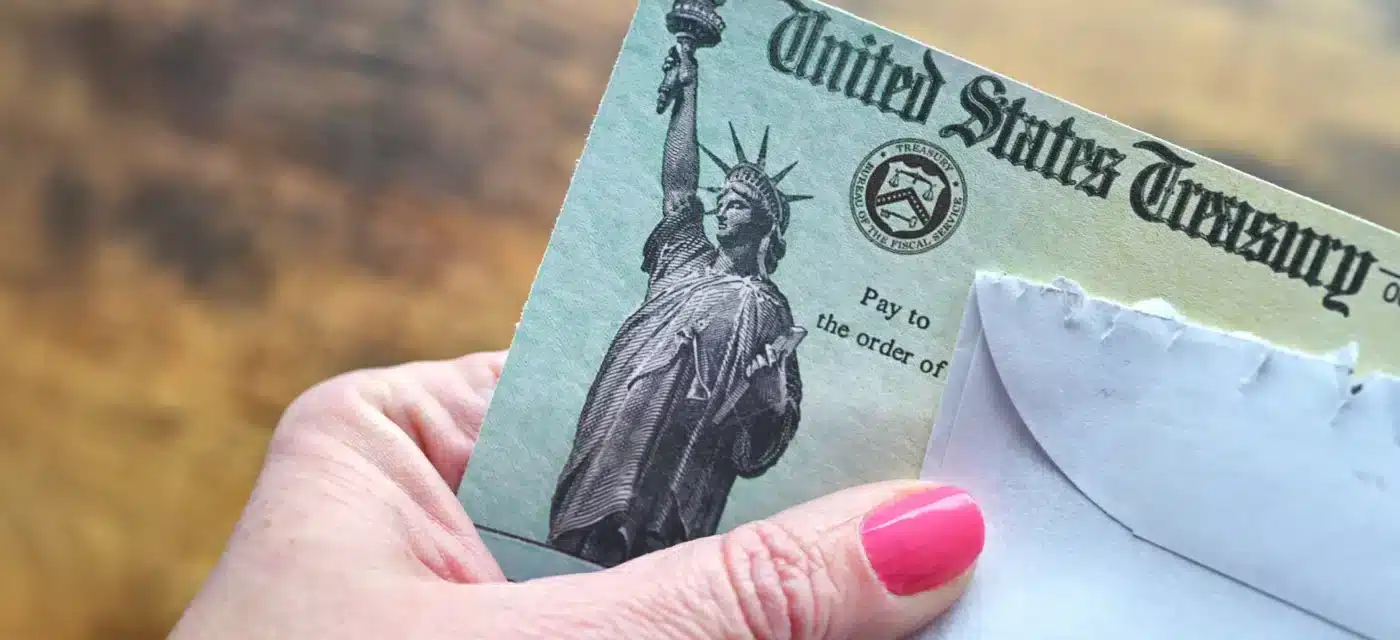

Paper Checks Eliminated – Why Government Check Recipients Need To Act Now

The federal government will soon eliminate paper checks for most federal payments. If you’re impacted, act now for a seamless transition.