Paper Checks Eliminated – Why Government Check Recipients Need To Act Now

The federal government will soon eliminate paper checks for most federal payments. If you’re impacted, act now for a seamless transition.

The U.S. Department of the Treasury recently announced that it’ll stop issuing paper checks for most federal payments on September 30, 2025. Disbursements for benefits – including Social Security, Supplemental Security Income, and Veterans – must now be made electronically with few exceptions.

These measures aim to increase processing efficiencies, reduce expenses, and enhance security. To maintain timely receipt of benefits, paper check recipients are required to transition to an approved electronic payment method.

Government Benefit Payment Options

People who currently receive paper checks should soon receive a notice explaining the changes as well as the benefits of switching to electronic payments. There are two convenient options to choose from:

Direct Deposit

Beneficiaries who have or establish an account with a financial institution are advised to enroll in Direct Deposit. Once set up, this convenient, hassle-free option sends funds straight to your savings account or checking account so you can easily access your money electronically or by using a card or check.

Key Benefits Of Direct Deposit:

- Receive your benefit up to two days early through direct deposit with A+FCU*

- No need to drive to make a deposit or cash a check

- Funds are available immediately; no check holds

- No need to worry about checks or cards getting lost or stolen through mail

Get Paid Up To Two Days Early

With your direct deposit at A+FCU, enjoy benefits such as an early payday, special product offers, and more.

Direct Express® Card†

Alternatively, people who don’t have a bank account can opt for a Direct Express card.† This is a prepaid card, not a debit card linked to a bank account, that’ll allow you to receive your federal benefit payments.

The funds would automatically be deposited to the Direct Express card on payment day. You could then use the card at stores that accept Debit MasterCard®, withdraw cash from Automated Teller Machines (ATMs), and get cash back when you make purchases. You can also use your debit card online to make payments.

While the card also offers a convenient and safe way to access your deposit, it has some drawbacks:

Direct Express® Card Drawbacks:

- Limit on free ATM withdraws per deposit

- Fees for transferring funds to a U.S. bank account

- Fees for card replacements and expedited delivery

- Currently, cash access is only available at limited authorized retailers

- May not be able to access funds quickly if your card is lost or stolen

The full fee schedule along with other Frequently Asked Questions can be found here.

Safety & Security

Keeping your personal and account information safe can be challenging. Use our tools and tips to help protect yourself from fraud and identity theft.

How To Enroll In Electronic Payments

While you can update your payment information directly with your paying agency, the federal government has also established the GoDirect page as an additional resource.

GoDirect enrollment options include:

- Establishing direct deposit online via the GoDirect site

- Calling 1.877.874.6347 to enroll for direct deposit or a Direct Express® Card

- Downloading, completing, and mailing a direct deposit form

A+FCU Direct Deposit Options

To establish Direct Deposit with your federal paying agency or using one of the options above, you’ll need to provide your banking information. A+FCU members can also establish direct deposit online or at a branch. Learn more about each option below.

Set Up With Paying Agency

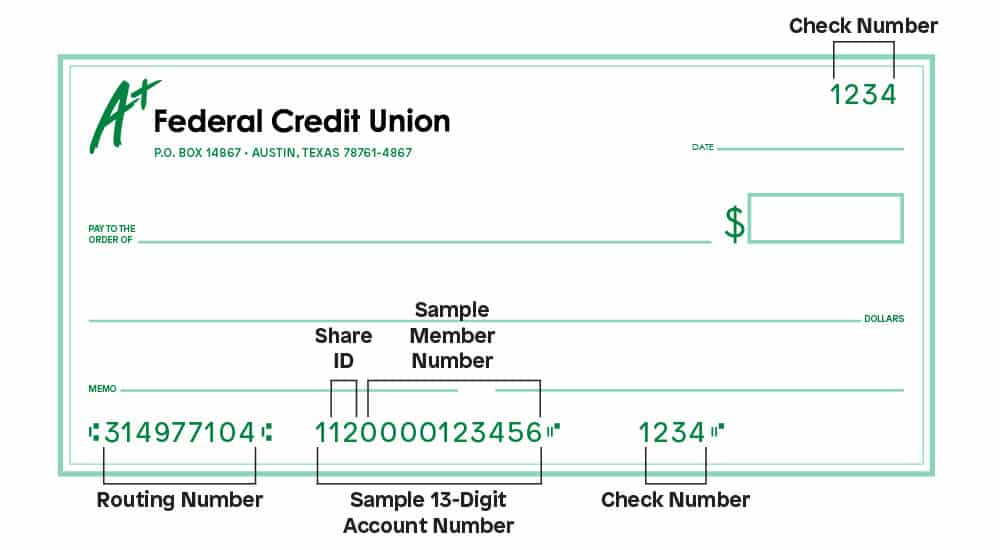

Be sure to make note of your full 13-digit account number, A+FCU’s routing number, and your share type – checking or savings.

Below are the details you may need, including instructions on how to locate your account number:

- Financial Institution Name: A+ Federal Credit Union

- Routing Number: 314977104

- Mailing Address: P.O. Box 14867, Austin, TX 78761

If you don’t have checks, you can also view your 13-digit account number by logging in to A+ Online Banking. After logging in, click into a specific share (such as checking) > Details & Settings > MICR/Account Number.

Set Up Online

Log in to A+ Online Banking or the A+ Mobile App to easily connect your checking or savings account to your paying agency’s payment system.

Once logged in, from the Menu select Services > Set Up Direct Deposit > Get Started.

From there you’ll be prompted to Get Started with our online service:

- Select the account you want your benefit deposited into

- Choose the entity that pays you (such as Social Security, Veteran’s Benefits, etc.)

- Enter required credentials to authenticate you within the payment system

- Confirm your direct deposit update

If the process is successful, you’ll see a message indicating your direct deposit has been updated. If your update fails, you’ll receive a message with further details to try again or set up manually.

Set Up At Your Nearest Branch

If you need assistance obtaining your direct deposit information or would like us to facilitate your direct deposit switch, stop by your nearest branch soon.

*Early payment of funds is not guaranteed and is subject to when A+FCU receives the funds from the originator.

†A+FCU does not issue or manage Direct Express® cards. The information presented in the blog is meant to be educational. For the most up-to-date information about Direct Express® cards, click here.

BALANCE

Take advantage of free financial education from our partner, BALANCE. From confidential coaching to videos and articles, get the resources you need to help with your fiscal matters.

Related Articles

4 Financial Steps To Take After A Natural Disaster

As your credit union, we’re always here to help if you need assistance. Here are four financial steps to take after a natural disaster.

How Long Should I Keep My Bank Statements and Financial Documents?

Determining whether to keep or shred bank statements and financial documents can be confusing – use our simple guide to get started.

3 Reasons To File Your Taxes ASAP

Tax season has begun and if your tax documents aren’t available yet, they will be soon! File ASAP to avoid these additional stressors.