Escrow Accounts

An escrow account often accompanies a mortgage or commercial real estate loan, so it’s important for borrowers to familiarize themselves with how the account works, associated disclosures, and important contacts and details.

Escrow Accounts

Simply put, an escrow account is an account that holds money until a transaction is complete. When purchasing real estate, buyers will encounter escrow accounts at different stages in the homebuying process.

While an escrow account can be used for different purposes, we’ll focus on how it relates to mortgages and commercial loans. The account is used to collect and pay for property taxes, homeowners insurance, and applicable insurance premiums. The escrow account also holds funds to cover your “required Escrow Account minimum balance”.

How Do Escrow Accounts Work & How Is The Payment Calculated?

Your lender will estimate costs for property taxes and insurance premiums for the next 12 months. The total is then divided by 12 and that amount is factored into your principal and interest payment to determine your total monthly payment.

When you make your payment each month, the escrow portion of your payment will be deposited into your escrow account.

Who Manages The Account?

The escrow account is managed by your lender, mortgage broker, or servicer. They’re responsible for paying property tax bills each year and paying insurance premiums when they’re due. If a payment is missed or is made late, they’re responsible for any penalties incurred.

Can Escrow-Related Bills Change Over Time?

Yes, escrow bills can change from year to year, causing your monthly mortgage payment to change accordingly. Here are some potential explanations for increases and decreases to the escrow portion of your monthly payment:

- Hazard Insurance: Insurance premiums can change due to changes to your coverage or your rate. Please contact your insurance company or your local insurance agent with questions about changes to your premium.

- Real Estate Taxes: Real Estate Taxes, also known as property taxes, can change due to property reassessments, a change in your tax rate, or a special assessment. Please contact your local tax office for any questions regarding changes to your real estate taxes.

- New Construction: Typically, the first tax bill for a new construction home only covers the lot/land. A subsequent bill is generally higher and is based on the fully assessed value of the land and the structure.

- Initial Escrow Deposit: Prior to closing, the escrow portion of the monthly mortgage payment is calculated based on the information available at the time – usually an insurance quote or existing premium amount and the prior year’s tax bill.

Requirements

The Real Estate Settlement Procedure Act (RESPA) protects borrowers by setting requirements for lenders, mortgage brokers, and servicers. The act requires timely and transparent disclosures, prohibits specific practices, and places limitations upon the use of escrow accounts.

Escrow Account Analysis

Since bills can fluctuate from year to year, your lender is required to conduct an analysis of your escrow account at least once a year to help ensure the account is properly funded for anticipated costs over the next 12 months. A+FCU conducts this review annually in January.

Annual Disclosure

Lenders are required to disclose in an Escrow Account Disclosure Statement the results of this review and its effect on your monthly mortgage payment. Occasionally, an interim statement is provided, if needed.

Required Escrow Account Minimum Balance

Federal law allows lenders to maintain up to a two-month minimum balance or cushion of funds in your escrow account to serve as a safeguard in the event of an increase in your escrow bills. This cushion can be no more than one sixth of your total annual escrow payments unless your mortgage contract or state law specifies a lower amount.

A+FCU Escrow Accounts

This results in a surplus. In case of a surplus, you typically receive a refund check if the surplus amount is $50 or more, and the escrow portion of your monthly mortgage payment is adjusted according to your new escrow bills. Details of these changes are sent to you in your Escrow Account Disclosure Statement. Your loan must be current when the escrow analysis is performed to receive a credit or refund of any surplus funds.

If your escrow account has a surplus amount of $50 or more, you typically receive a refund to the mailing address* on file within 30 days of receiving the disclosure. If you have additional questions, please email requests to [email protected] or [email protected] for commercial loans.

*If your mailing address has recently changed, please update this as soon as possible.

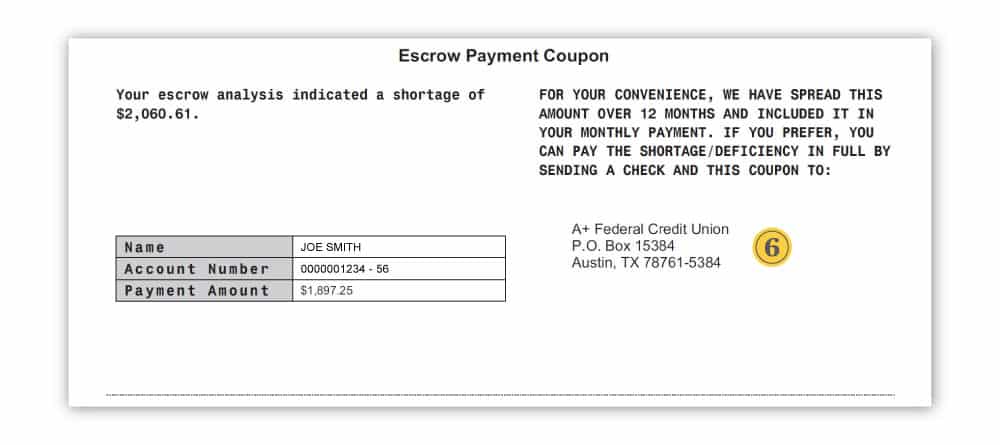

This results in a shortage. We spread your shortage over the next 12 months in addition to adjusting the escrow portion of your monthly payment amount, or you can choose to pay the shortage in full by the date listed in the Escrow Analysis Disclosure Statement. Please include the coupon from the statement when mailing a check to A+FCU.

Yes, it can. Even if you pay the shortage resulting from last year’s escrow payments, an increase in your projected tax bill or insurance premiums for the coming year could result in your payment increasing.

Contact Us

If you have a past due property tax or insurance bill, or if any bill has been added, removed, or updated, please don’t make a payment and contact Mortgage Servicing at 512.302.6800, ext. 2884.

Please forward any new bills to the corresponding email address: [email protected] or [email protected].

For changes to or outstanding commercial real estate bills, please email [email protected] or contact us at 512.302.6889, option 2.

Important Details

If you have questions about your property tax bill, property appraisal, tax rates, etc., contact your local taxing authority.

Local taxing units offer partial and total exemptions, such as those listed here, from a qualifying property’s appraised value.

Contact your local taxing authority to inquire about qualifying and applying for exemptions that could be used to reduce your property’s taxable value.

A+FCU completes the escrow analysis in January each year. Members can expect to receive their Annual Escrow Disclosure Statement by mail, typically during the first week of January.

If your payment changes after the annual escrow analysis is conducted, you’ll need to update previously established automatic payments that are not initiated directly by A+FCU.

Reminders:

- If your payment has changed and you make your payments through a bill pay service, please be sure to update the payment amount.

- If your payment is set up on auto-transfer (also known as a recurring transfer) through A+ Online Banking, please make sure to update the payment amount.

- If your payment is set up directly with A+FCU, then no further action is required. The payment will automatically adjust.

Understanding Your Statement

Please review your Annual Escrow Disclosure Statement once it’s available. If you have questions or if there are discrepancies with the statement, please contact A+FCU as soon as possible to allow time to make any necessary adjustments prior to your first payment due date. The Mortgage Servicing team can be reached at 512.302.6800, extension 2884. The Commercial Servicing team can be reached at 512.302.6889, option 2.

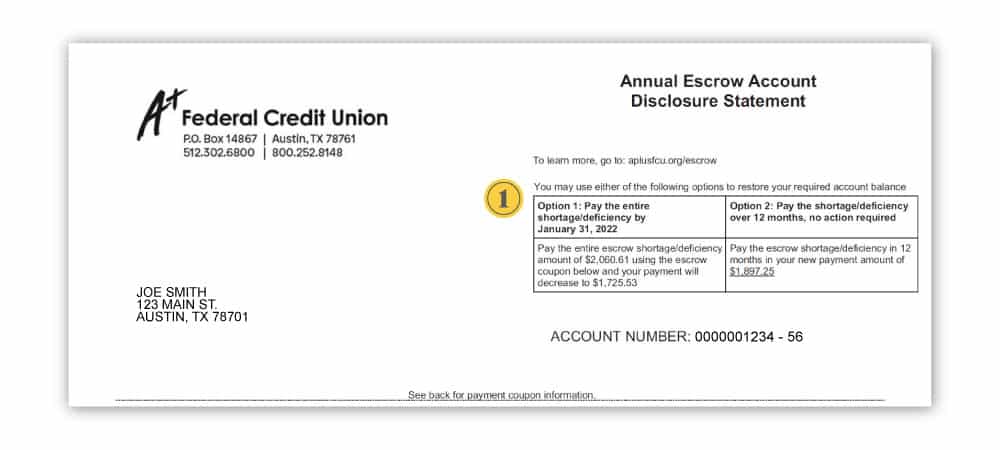

These are the two options available regarding the mortgage payment.

Option 1: Gives the option to cover any shortage/deficiency, if applicable. If option one is chosen, please make sure to include the coupon on the back of the Escrow Account Disclosure Statement. Your shortage/deficiency payment will be deposited to your escrow account and the calculated monthly payment will be adjusted accordingly.

Option 2: Does not require any action. You will pay the new total monthly payment listed on your Escrow Statement.

Federal law requires that we analyze your account each year to determine whether the current balance and the amount of money we collect each month is appropriate based on the bills that we expect to pay over the next 12 months.

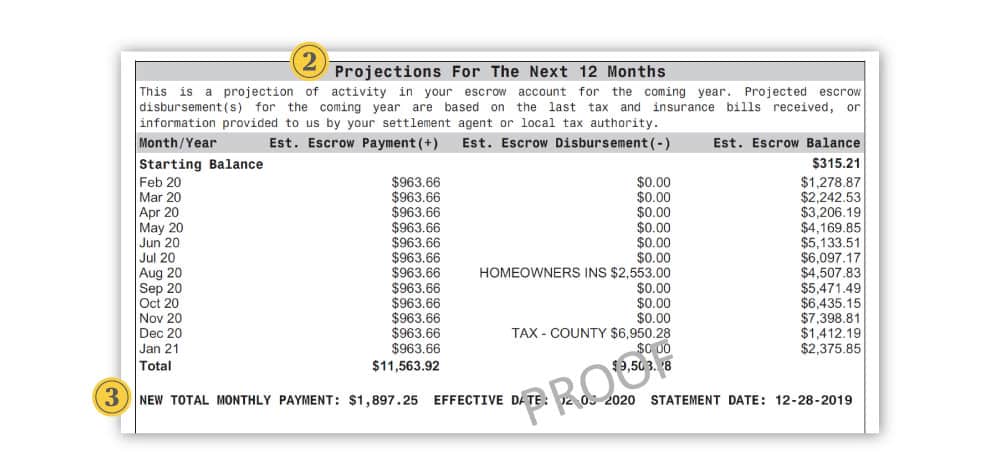

This section contains a projection of escrow activity for the coming year. Projections include monthly payments into the escrow account and escrow disbursements out of the account based on last year’s activity. Please note that if Property Taxes or Insurance Premiums increase during the year, your escrow balance may reflect a shortage the following year.

If applicable, this section reflects your new total monthly mortgage payment.

The effective date represents the starting due date of the new total monthly payment.

The statement date reflects the date we ran the analysis prior to the due date for your projected mortgage payment for the next 12 months.

Notice: Please contact us if you know of any bills that should be added to or removed from this section, or if the amounts and/or due dates are incorrect.

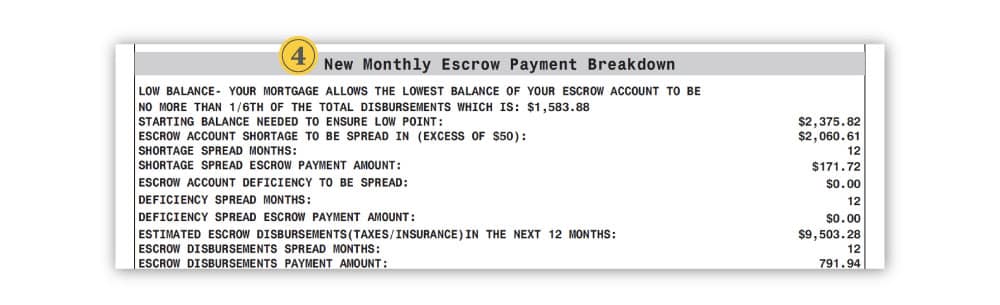

This section contains a complete breakdown of your New Monthly Escrow Payment.

Low Balance – Your Mortgage Allows The Lowest Balance Of Your Escrow Account To Be No More Than 1/6th Of The Total Disbursements

The low point equals the lowest monthly escrow balance during the 12-month projection. An escrow balance is projected for a 12-month period, assuming that A+FCU receives scheduled payments and makes scheduled disbursements (pay property taxes, insurance premiums, etc.).

Starting Balance Needed To Ensure Low Point

The starting balance needed to ensure the account has enough funds to cover all property taxes, insurance premiums, etc.

Escrow Account Surplus, Shortage, Or Deficiency To Be Spread In (Surplus In Excess Of $50)

- A surplus is the portion of the projected escrow balance that is greater than the cushion amount.

- A shortage is the amount by which the escrow balance falls short of the cushion amount.

- A deficiency is the amount by which the balance goes below zero. When the account has a deficiency, it will also have a shortage.

A surplus in the amount of $50 or more is refunded in the form of a check sent via mail, while surplus amounts under $50 are returned by lowering the monthly escrow payment due.

Example: $48 surplus divided by 12 months = $4 decrease to the monthly escrow portion

Surplus, Shortage, Or Deficiency Spread Months

Monthly payment amount reduced or added to the monthly escrow based on the surplus, shortage, or deficiency divided over 12 months.

Example: $1,200 shortage divided by 12 months = $100 added to the monthly escrow portion

Estimated Escrow Disbursements

Total estimated amount of any tax, insurance, and any other escrowed items anticipated to be dispersed from the escrow account.

Escrow Disbursement Spread Months

Number of months the escrow disbursement(s) will be divided by. Disbursements are divided by 12 months and added to the monthly payment.

Example: $5,100 for tax, insurance, etc. divided by 12 months = $425 per month

Escrow Disbursements Payment Amount

Monthly payment amount of the total estimated escrow disbursements.

Example: $5,100 for tax, insurance, etc. divided by 12 months = $425 per month

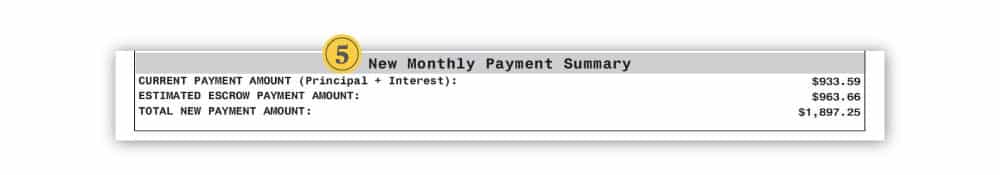

Current Payment Amount. This is the principal and interest portion of your mortgage payment. This amount does not change throughout the life of the loan unless your loan is an Adjustable Rate Mortgage.

Estimated Escrow Payment Amount. The new total escrow portion of your monthly mortgage payment. This amount includes any taxes, insurance, and/or other payments needed.

Total New Payment Amount. The new monthly payment which is composed of principal and interest, the escrow collection for taxes and insurance and any additional collection(s) that may be required to cover a shortage/deficiency in the escrow account.

Reminders:

- If your payment has changed and you make your payments through a bill pay service, please be sure to update the payment amount.

- If your payment is set up on auto-transfer (also known as a recurring transfer) through A+ Online Banking, please make sure to update the payment amount.

- If your payment is set up directly with A+FCU, then no further action is required. The payment will automatically adjust.

Use this coupon to make the shortage/deficiency payment. This is the coupon for Option 1 on page 1.

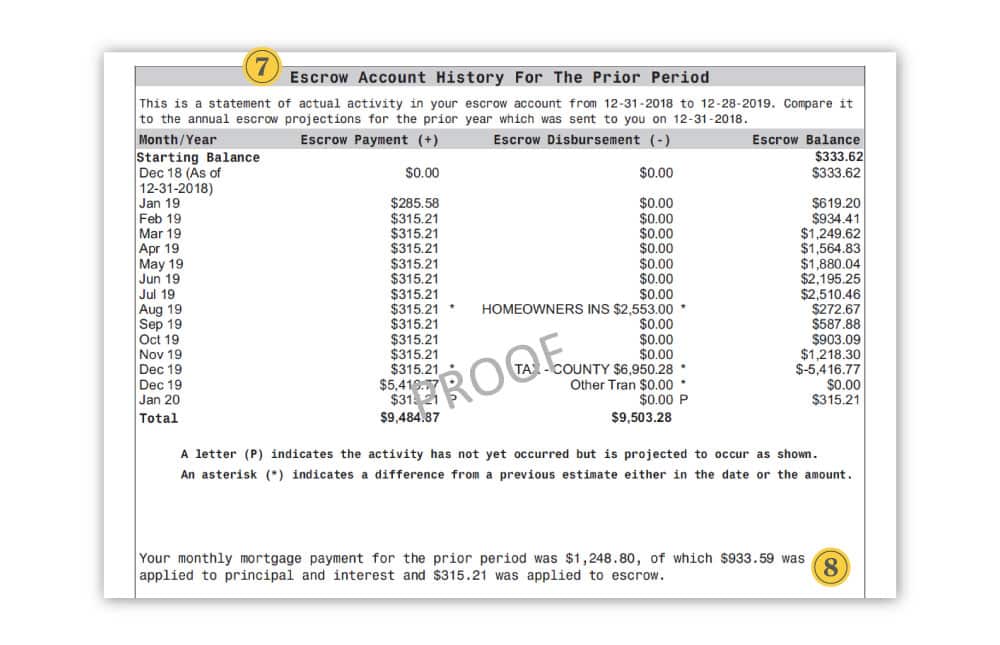

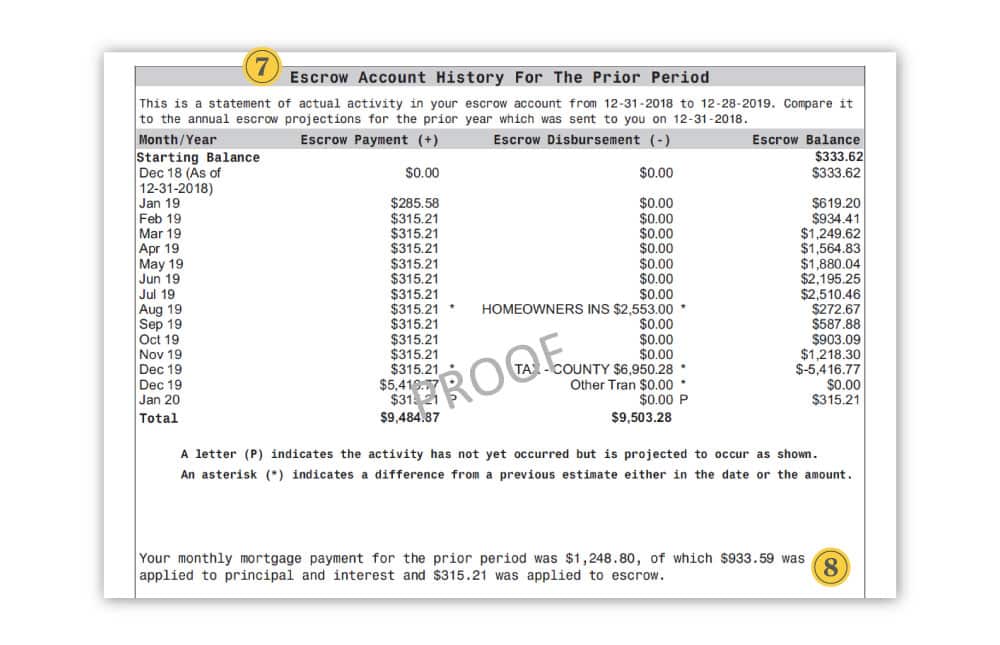

This section shows monthly transaction details of payments to and disbursements from your escrow account since the last escrow analysis calculation date.

This section shows the total monthly mortgage payment from the last computation period. There is also a breakdown of the total monthly payment to show what amount went to principal and interest and the amount applied to escrow.

Note: If your mortgage recently transferred to us from another servicer, the projected deposits and payments from your previous statement may not be available.

Membership required. Insured by NCUA. All accounts screened through ChexSystems. Conditions and restrictions may apply. Subject to change without notice.

Programs, rates, terms, and conditions are subject to change without notice. Normal lending criteria apply. All loans subject to credit approval. Property must be located in Texas and primary owner-occupied single-family residence. NMLS #405608.

![]()

Rates & Resources

To keep you from having to do all the math, we’ve provided rates & calculators for all kinds of situations.

Buying & Selling A Home

The process of buying and selling a home can be stressful – even for experienced homebuyers. If you’re ready to make the move, check out these resources to confidently make decisions and enjoy a smoother experience.

Personal Finances

Financial health is a key part of overall wellness. Count on us to provide the knowledge and tools you need to make sense of your money, better your financial journey, and improve your peace of mind.

Related Articles

16 Months Of Financial Tips

Use these monthly financial tips to break down your top financial tasks and to-dos and get on the right path to being financially healthy.

What To Do If Your Income Is Reduced

When your income drops, every financial choice matters. From trimming spending to exploring safer borrowing options, these tips can help you navigate difficult times.

7 Tricks To Stay On Budget

Need help managing your finances? We’re sharing our tips to help you better plan, organize, and track your spending so you can stick to your budgeting plan.

Refer. Earn. Repeat.

Referring is easy. And the more you refer, the more you earn — up to $500 every year!