Why Reviewing Your Credit Report Regularly Is Key

Credit reports influence your credit score and can help you spot identity theft red flags. Learn more on why reviewing your credit report regularly is key.

Your credit report provides a snapshot of your credit history and is used by different entities, such as lenders, insurance companies, and landlords, to evaluate your credit worthiness and ability to pay.

It’s recommended you view your credit report regularly to ensure accurate reporting and identify any issues. This recent survey, however, found that 27% of respondents didn’t review their credit report at least once a year — and that can have big implications.

Here’s why you want to review your credit report on a regular basis.

Reasons Why Reviewing Your Credit Report Regularly Is Key

1. Have An Understanding Of What’s On Your Credit Report

If you’ve never obtained your credit report or haven’t reviewed it recently, it would be helpful to see what all is included in the report. This is especially important if you’re considering applying for credit or if you know a third-party will need to access your credit report in the near future.

Obtaining your credit report is easy, doesn’t cost anything, and doesn’t impact your credit score. There are three major credit reporting agencies that furnish the reports: Equifax®, Experian™, and TransUnion®.

While credit reports will look different depending on which credit bureau provides the free report, they can be obtained at annualcreditreport.com on a weekly basis and include the same information:

- Current and former names used

- Social Security number

- Date of birth

- Current and former addresses

- Phone numbers

- Employer names

- Current and closed accounts

- Name of creditor

- Credit limit or amount borrowed

- Account balance

- Payment history

- Opened and closed date (if applicable)

- Missed payments

- Debt sent to collections

- Unpaid child support

- Foreclosures

- Bankruptcies

- Soft and hard inquiries resulting from companies accessing your credit report

Obtaining your credit report is easy, doesn’t cost anything, and doesn’t impact your credit score.

2. Spot Reporting Errors

A Credit Checkup conducted by Consumer Reports and WorkMonkey found that 44% of participants who checked their credit report found at least one mistake. Errors can negatively impact your credit score and, depending on the type and severity, can prevent you from obtaining credit.

Three Main Types Of Errors

| Error Type | Examples |

|---|---|

| Account Related |

|

| Derogatory Mark |

|

| Personal Information |

|

Fixing Errors

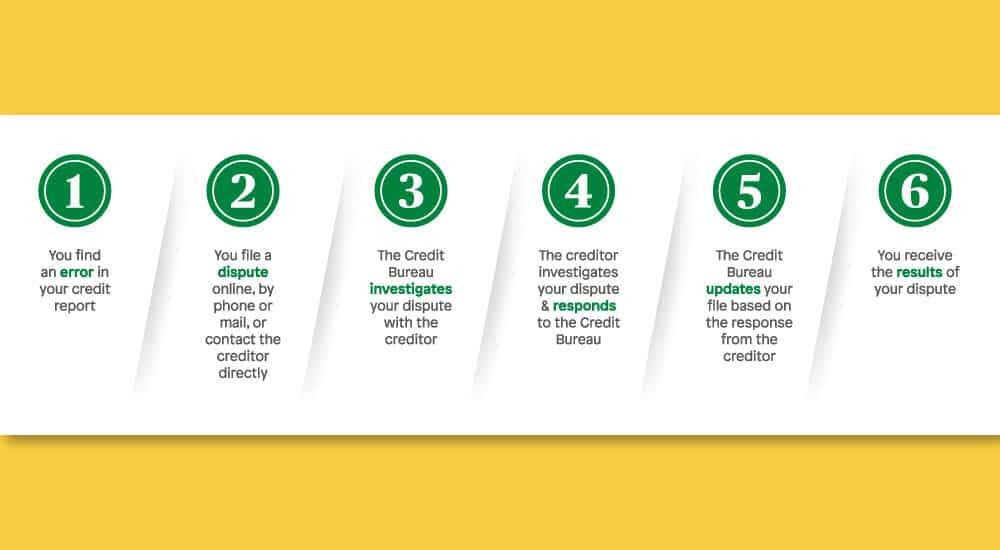

It’s important to address any errors on your credit report by disputing the information with one of the three credit bureaus: Equifax®, Experian™, or TransUnion®. Errors that may impact your credit score can include but are not limited to overstated balances, inaccurate payment history, incorrect account status, outdated information, and credit file mix-ups due to having a common name.

Consumer reporting agencies are required to correct or delete inaccurate, incomplete, or unverifiable information and may not report outdated negative information. They generally have 30 days to investigate and verify the information that’s being contested.

Fraud Protection

You work hard for your money. We want to help protect it by sharing tips to help recognize scams, deter fraudsters, and take appropriate action if you fall victim.

Examples Of Red Flags

| Unfamiliar accounts or debts | Wrong address |

| Unusual inquiries | Incorrect employer |

| Unknown account activity |

If you suspect you’re a victim of identity theft, it’s important to act fast and file a report with the Federal Trade Commission at identitytheft.gov. When you do so, you’ll get a personalized recovery plan that’s based on the extent of the fraud and what information was compromised.

Summary

Reviewing your credit report is an important part to becoming and staying financially healthy. It can ensure your credit score best reflects your relationship with credit while also helping you identify possible fraud so you can act swiftly.

BALANCE Credit Coaching

Interpreting and correcting your credit report can be confusing. As a benefit of your A+FCU membership, you can work with an expert to get tailored guidance at no cost to you.

Related Articles

Your Guide To Buy Now, Pay Later Apps

Find out what you need to know about this popular checkout option.

Essential Questions For Loans: What To Ask Before Borrowing

It’s important to be aware of a loan’s ins and outs before accepting it. Use these key questions for loans to help you understand and compare your options.

How To Tackle Debt In The New Year

Are you ready to make a plan to pay off debt? Use these tips to help start your new year with good habits to help you reach your goals.