What You Need To Know About The New SAVE Plan For Student Loans

The newest income-driven plan is now available and has unique benefits that’ll lower payments for many borrowers – find out if you’re one of them.

The Biden administration announced the Saving on a Valuable Education (SAVE) Plan in June 2023. The plan will put monthly payments at $0 for many borrowers and save others up to $1,000 monthly. Here’s how to know if you’re eligible and what to do if you are.

Important Questions To Ask

What’s The Plan?

The SAVE plan is a new type of income-driven repayment (IDR) plan that, like other IDR plans, calculates your payments based on your income and family size. However, it offers multiple new benefits for borrowers that weren’t available before.

What Types Of Loans Are Eligible?

Eligible Loans Include:

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- Direct PLUS Loans made to graduate or professional students

- Direct Consolidation Loans that didn’t repay any PLUS loans made to parents

Loans That Aren’t Eligible:

- Direct PLUS Loans made to parents

- Direct Consolidation Loans that repaid PLUS loans made to parents

- FFEL PLUS Loans made to parents

- FFEL Consolidation Loans that repaid PLUS loans made to parents

- Any loan currently in default

What New Benefits Does It Provide?

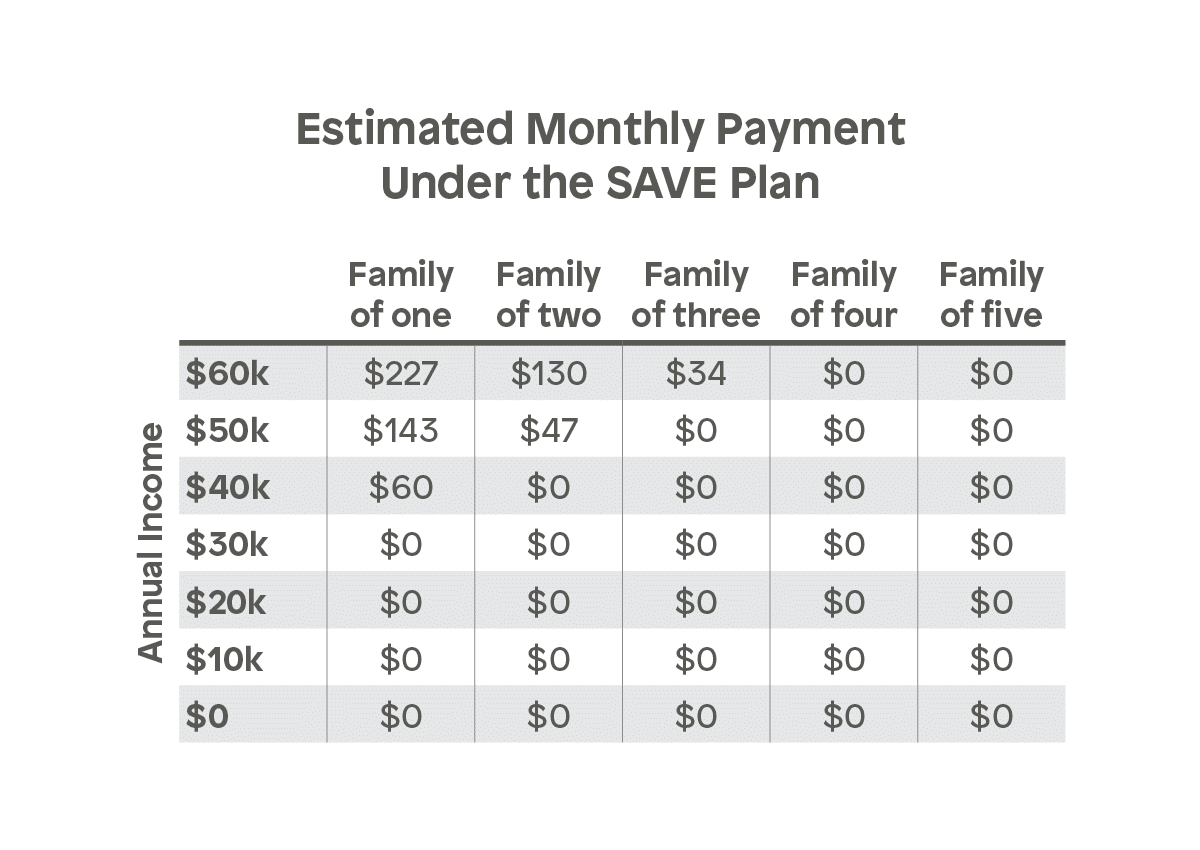

Under the SAVE Plan, your monthly payments won’t be more than 10% of your discretionary income, which for these purposes is your adjusted gross income from your taxes minus 225% of the federal poverty line for your household size. For individuals in 2023, that latter part of that equation comes to about $32,800 annually or a little over $2,730 monthly. If you live in Alaska or Hawaii, please note that the poverty level numbers will differ.

If you make less than $32,800 as an individual, your monthly payment under the SAVE Plan will be $0. As your income or family size changes, the amount you pay under the SAVE Plan will be adjusted. To help make this process easier, you can allow the Department of Education access to your tax information each year.

With the SAVE Plan, you won’t be charged any additional interest once you’ve met your monthly payment obligation. That means your account balance won’t grow – even if your monthly payment is $0. Another new feature under the SAVE Plan is that if you’re married and file your taxes separately, spousal income isn’t included in your required payment amount calculations.

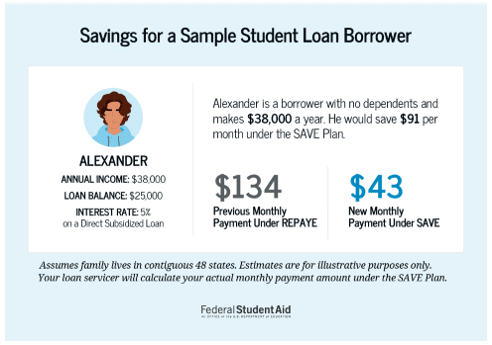

What If I Was On The Revised Pay As You Earn (REPAYE) Plan?

The SAVE Plan replaces the REPAYE Plan. If you were on the latter, you would automatically get the new advantages provided by the SAVE Plan.

What If I Don’t Know What Kind Of Loan I Have Or Repayment Plan I’m On?

If you need help determining what type of loan you have, you can log in at your loan servicer’s website to determine this information. If you’re not sure who your servicer is, create an account at studentaid.gov, and in the dashboard for your account, select My Loan Servicers. You can also find information on your current repayment plan there as well.

What If My Loans Are In Default?

You might qualify for the Fresh Start initiative to rehabilitate your loans and put them in the SAVE Plan if you’re currently in default.

If you’re delinquent but not yet in default, you can still participate in the SAVE Plan.

What’s Coming In The Future?

Even more plan advantages will be activated in July 2024. Some of these benefits are:

- Payments on undergraduate loans will be reduced to 5% of the difference between adjusted gross income and 225% of the poverty level. If you have undergraduate and graduate loans, you’ll pay a weighted average of 5-10% based on the original amount you borrowed.

- Loan forgiveness will be granted once you’ve been making payments long-term under the SAVE Plan, with the qualifying timeframe being based on the principal balance of the loan. Once you’ve paid for at least ten years on the plan, a balance of less than $12,000 will be forgiven. The qualifying repayment period for forgiveness goes up by one year for every additional $1,000 borrowed, with a cap of 20 or 25 years, depending on the type of degree you received.

- If you’re late by 75 days, you’ll automatically be placed in an income-driven repayment plan as long as you’ve agreed to have your tax information accessed by the Department of Education.

Are Forgiven Loan Balances Taxable?

There’s currently a temporary federal rule in place prohibiting the taxing of forgiven loan balances that expires in 2025. However, it’s always a good idea to consult a tax professional when part of a debt has been forgiven to ensure you fully understand any tax ramifications.

How Do I Know If The SAVE Plan Is Right For Me?

A loan simulator tool is available at studentaid.gov to help you test out different repayment options before committing.

How Do I Apply?

The SAVE Plan is already in effect, so you can apply at studentaid.gov now. Even if you’re currently on a different repayment plan, you can switch to a SAVE Plan.

Summary

Undoubtedly, many Americans will save a lot of money as they repay their student loan through the SAVE Plan. It’s certainly worth investigating your options to see if you too could benefit.

After College Graduation

If you have student loans, you’ll need to prepare for repayment when the time comes. Use our resources to explore everything from repayment plans to loan forgiveness and relief.

Related Articles

Preparing For Student Loan Repayment

Are you ready to add your student loan payments into your budget? Prepare using these helpful tips.

How To Fit Student Loan Payments With Your Financial Goals

Don’t let student loan payments overwhelm your budget. Reach your financial goals with these tips.

7 Money Saving Tips For College Students

Managing money while in college can be challenging. Here are some money-smart tips to help you save and budget.