3 Reasons You Should Always Pay More Than The Minimum

Find out why always paying more than the minimum payment each month helps you financially.

Credit cards are a valuable financial tool for both individuals and businesses – but they come at a price.

You get purchasing power on the spot, and the creditor only requires you to pay off a small amount of the total every month, i.e., the minimum amount due. However, it’s important to remember the minimum is calculated in the best interest of the creditor, which puts you at a disadvantage.

What’s A Minimum Monthly Payment?

A minimum payment is the least amount you can pay toward the balance you’re carrying without any penalties or fees accrued. If you look back at your minimum payments, you’ve probably noticed they vary each month. This makes it harder to budget for, so leaving some wiggle room for your credit card payment is a must.

Typically, the minimum payment is calculated between 2%-5% of your statement balance, so planning in advance to pay more on your card can benefit you greatly.

Here are some important reasons why you should always pay more than the minimum due on your credit card.

Three Reasons Why Paying More Helps

You’ll Always Save Money

When you only pay the minimum every month, you end up paying more in interest. The minimum payment exists to ensure that interest fees are covered, with only a small amount going toward the actual balance.

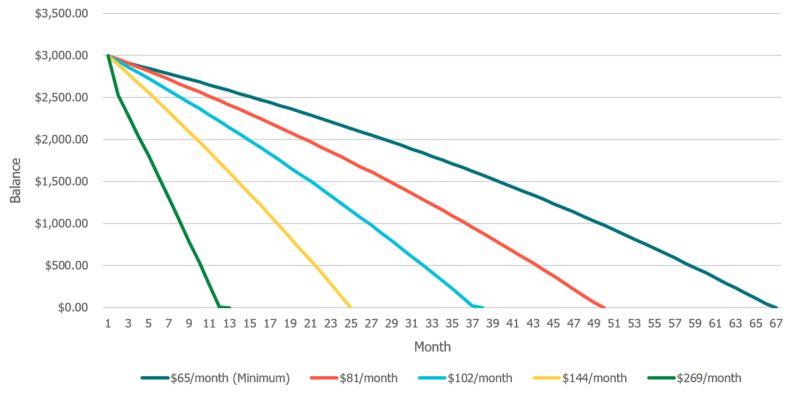

For example, suppose you have a $3,000 balance with a 14% APR (Annual Percentage Rate). Your minimum payment would be around $65. By the time you pay it off, you will have paid an additional $1,332 in interest.

On the other hand, if you were to pay $100 every month instead of $65, you would only pay $713 in interest.

Free Debt Roll-Down Calculator

The roll-down method is one technique for paying off your credit cards and other debt. This calculator will help you develop a plan to focus your efforts on higher-interest debt and save.

You’ll Become Debt-Free Faster

The more you pay, the quicker you’ll be debt-free. Using the same example, it would take 67 months to pay off the original $3,000 balance, along with all that extra interest. That’s five and a half years!

Instead, paying $100 per month instead would clear the debt out in approximately 38 months, which is just over three years. Of course, this is provided you’re not adding additional debt to the card and your APR remains at 14%.

It Raises Your Credit Score

The ratio of your balances to your credit limits is called “credit utilization.” This ratio accounts for 30% of your entire credit score.

For example, a credit limit of $2,000 with a balance of $500 would mean you have a credit utilization of 25%. A lower ratio is better because it shows you’re using only a small amount of the total credit that has been extended to you.

If you’re only paying the minimum, your balance may remain high relative to your total credit limit. This will cost you some points on your score. Naturally, this also means when you begin making higher payments that quickly bring down your balance, you’ll likely see an increase in your credit score to reflect this change.

Summary

So, what’s the solution to avoiding the minimum payment trap? Whenever possible, pay off your balances in full every month.

Copyright BALANCE

Debt

To get out of debt, you need to be intentional with your money. Reach your goals faster with our tools for evaluating your debt load, developing a repayment strategy, and staying committed.

Related Articles

Why Reviewing Your Credit Report Regularly Is Key

Credit reports influence your credit score and can help you spot identity theft red flags. Learn more on why reviewing your credit report regularly is key.

How To Tackle Debt In The New Year

Are you ready to make a plan to pay off debt? Use these tips to help start your new year with good habits to help you reach your goals.

Better Alternatives To Payday Loans

Stuck in a money rut and need some help? Try these stress-free alternatives to payday loans that actually save you money.