Direct Deposit & Payroll Deduction

Make payday a breeze with direct deposit. Send your paycheck or government benefit straight to your account without visiting a branch or cashing a paper check.

Get Paid Up To Two Days Early With A+FCU

Many employers, businesses, and government entities use direct deposit as their main way of paying employees or sending money to individuals. This convenient, hassle-free option sends a paycheck, deposit, or government benefit straight to a payee’s account of choice. And with A+FCU, you could even receive your paycheck up to two days early.*

Payroll deduction lets you set aside money from your paycheck into accounts of your choosing.

Connect Your A+FCU Account Online

Log in to A+ Online Banking or the A+ Mobile App to easily connect your checking or savings account to your employer’s payroll systems.

Once logged in, from the Menu select Services > Set Up Direct Deposit > Get Started.

From there you’ll be prompted to Get Started with our online service:

- Select the account you want your paycheck deposited into

- Choose your employer or payroll provider

- Enter required credentials to authenticate you within the payroll system

- Adjust the amount of your paycheck deposited if needed (options for entire or specific amount, or a percentage)

- Confirm your direct deposit update

If the process is a success, you’ll see a message that your direct deposit has been updated. If your update fails, you’ll receive a message with further details to try again or set up manually.

Frequently Asked Questions

You’ll first need to identify your employer or payroll provider. Then, you’ll authenticate in the system. The information required to do so varies by employer/payroll provider and may include:

- Username or EIN

- Company identifier or store location

- Password

You’ll have the option to select between any deposit account that you have deposit rights to through A+ Online Banking. You can also adjust the amount to have direct deposited into your A+FCU account. This can be the entire deposit, a percentage, or a specific amount.

It can take 2-3 pay cycles for the switch to take effect as time is needed on the payroll side to honor the request. However, most payroll providers will display the “change” within their system within minutes.

After this time frame, you’ll know your direct deposit setup was successful when you receive funds on or before your expected payday.

Yes! This service is a trusted and secure way for A+FCU members to switch their direct deposit electronically.

If your employer or payroll provider is not listed, you’ll be given a “Try it Manually” option. This option will take you to our direct deposit form so you can provide an official document to your HR department to have your direct deposit switched.

No. We DO NOT charge our members a fee for this service.

Yes. The switch will work for joint signers.

Please contact us at 512.302.6800, send a secure message through A+ Online Banking, or visit any of our branches for assistance.

Get Started

Ready to get your account set up online? Easily enroll in A+ Online Banking and start managing your finances.

Setting Up Direct Deposit Manually

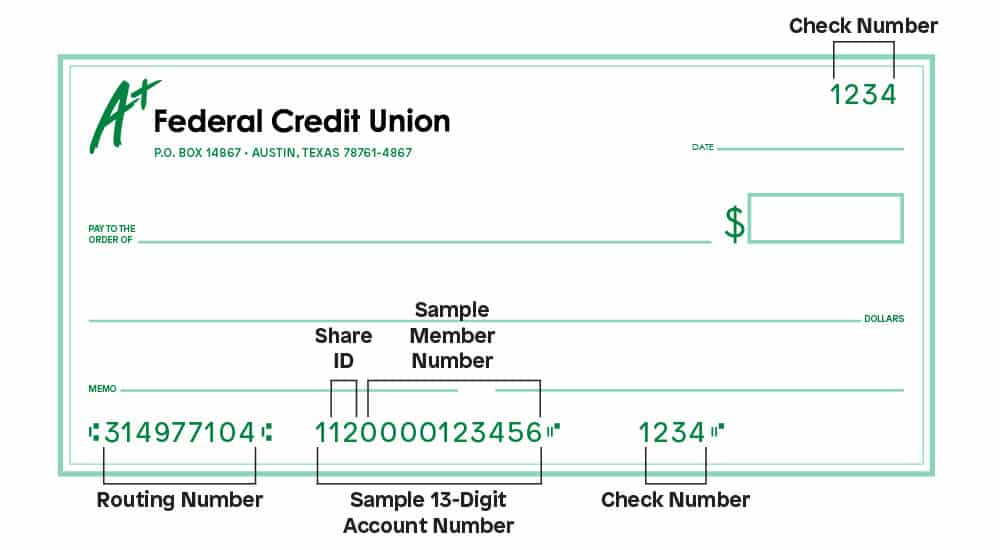

To enroll in direct deposit or set up payroll deduction with your employer, you’ll need:

- Routing Number

- 13-digit account number

- Account type: checking or savings

- Financial institution’s name and mailing address

- Voided check (not always required)

A+FCU Information

- Financial Institution Name: A+ Federal Credit Union

- Routing Number: 314977104

- Mailing Address: P.O. Box 14867, Austin, TX 78761

Your A+FCU Account Information

You will need your full, 13-digit A+FCU account number. Your 13-digit account number and share type can be found by logging in to A+ Online Banking. After logging in, click into specific share (such as checking) > Find MICR/Account Number (top right).

Your 13-digit account number will always begin with a 1, followed by a two-digit Share ID, and the final ten digits are leading zeros plus your member number. In the check example above, the 13-digit account number is 1120000123456, which breaks down as: 1, the two-digit Share ID (12), the series of leading zeros (0000), and finally the member number (123456).

Pre-Filled Form

For your convenience, A+FCU members can access a pre-filled direct deposit form from within A+ Online Banking or the A+ Mobile App.

After logging in, click Services > Direct Deposit Form. Fill in the requested information including the account to which you want to receive your funds.

On this form is an image of a sample check, your account information, and A+FCU’s mailing address and phone number. Submit this form to your employer, or carefully copy over the required information if they have their own form.

Benefits Of Direct Deposit

There are many benefits to direct deposit with A+FCU. First, you could receive your paycheck up to 2 days early.* It’s also available at no cost and is less risky for payees.

Other benefits:

- Avoids check cashing fees

- Doesn’t require a trip to the credit union

- Avoids potential check hold

- Funds are immediately available on scheduled payday

- May be able to split deposit amongst accounts

- Can be used to establish automatic savings

- Creates electronic records

- More environmentally friendly

*Early payment of funds is not guaranteed and is subject to when A+FCU receives the funds from the originator.

Resources

Make the most of your A+FCU membership with these resources to help you manage your accounts and better your finances.

Budgeting

Ready to take control of your finances? See what steps to follow to develop a spending and saving plan and follow through on it.

Personal Finances

Financial health is a key part of overall wellness. Count on us to provide the knowledge and tools you need to make sense of your money, better your financial journey, and improve your peace of mind.

Related Articles

Lifestyle Creep: What Is It & How Can You Avoid It

Lifestyle creep quietly drains the progress from your rising income. Learn how to avoid it and take control of your finances with these tips.

11 Ways To Live More Energy-Efficient

Living green can include making big or small changes to your lifestyle. Save the environment – and your wallet – with these tips to live more energy-efficient.

16 Months Of Financial Tips

Use these monthly financial tips to break down your top financial tasks and to-dos and get on the right path to being financially healthy.

Join The A+FCU Family

Joining is easy and comes not only with a wide variety of money-saving products tailored to fit your needs, but also exclusive member-only benefits.