Join A+FCU & Live Your A+ Life

When you join Austin’s Best Credit Union, you’ll enjoy A+ banking services tailored to your needs – plus we’ll kick start your savings with $50!* Use Promo Code 2025OFFER50 when you open your account.

Join With A Special Offer

Open a free Cash-Back Checking Account and we’ll reward you with $25! Earn an additional $25 with your first payroll direct deposit(s) totaling $800 or greater.*

Live your A+ life and join the thousands of members earning unlimited cash back on every purchase no matter how big or small.

Ready to open your account? Click the button below to begin the process.

Use promo code 2025OFFER50 when you open your account online or in person.

Every Cash-Back Checking Account Includes:

- No minimum monthly balance and no monthly fees

- Unlimited Cash Back paid monthly for Debit Card purchases

- Earn PlusPoints to save on loans and earn more on certificates

- FREE Visa EMV Chip Debit Card

- FREE Online Banking

- FREE Mobile Banking with Mobile Deposit

- FREE Bill Pay

- FREE eStatements

- FREE Access to thousands of surcharge-free ATMs across the nation

- FREE New Member Cash Reward

Who Doesn’t Love An Early Payday?

Enroll in direct deposit and enjoy the A+ benefit of having your paycheck delivered up to 2 days early.** Plus, with this special joining offer, you’ll receive an additional $25 into your Membership Savings Account.*

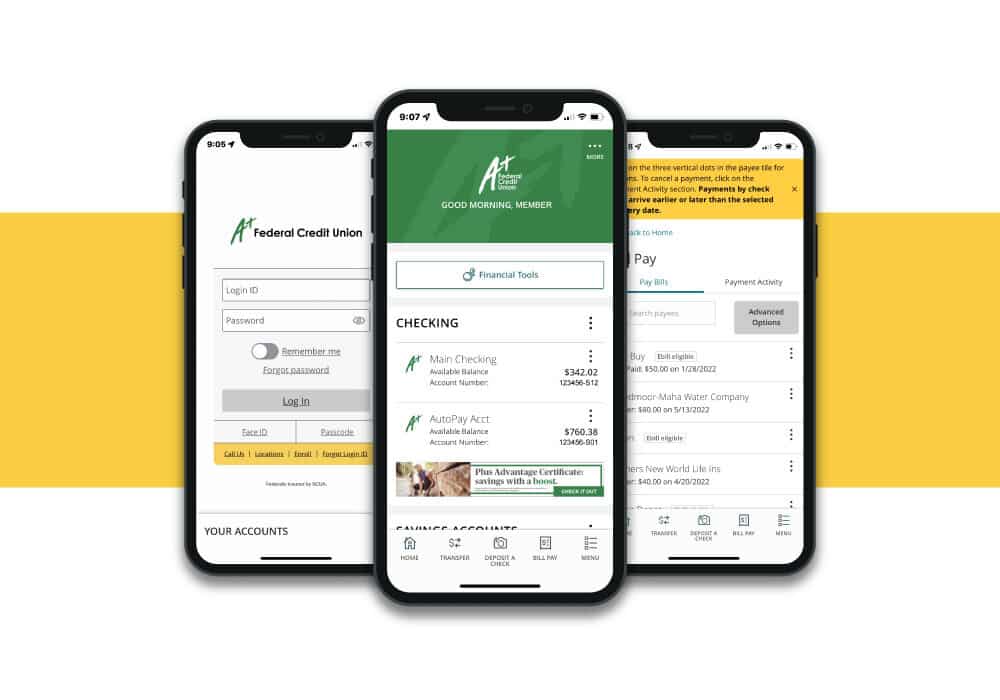

Save A Trip To The Branch

The financial tools you need to access your accounts are just one tap away with the A+ Mobile App.

What Our Members Have To Say

Great member service, friendly staff. Would highly recommend A+ to anyone who would like to join.

– Jacqueline H.

After 5+ years of banking with A+FCU, I have had nothing but an overwhelming positive experience. Definitely a good credit union for day-to-day use.

– Douglas F.

I think the Cash-Back Checking and ATM Debit Card Programs are great incentives for members by rewarding us based on our use of the program and $ spent.

– Jacqueline N.

How To Join Online

Tiered Money Market

Grow your savings with higher dividends and the flexibility you need including no minimum opening balance requirements, no transfer or withdrawal limit, and no monthly fees. As your balance increases, so does your dividend rate!

Insured by NCUA. Membership required. Conditions and restrictions apply. New accounts screened through ChexSystems.

*Must open a Membership Savings and a Cash-Back Checking Account with a debit card and direct deposit. $25 will be deposited into your Membership Savings Account upon account opening. Another $25 will be deposited into your Membership Savings Account within a week of the date your payroll direct deposits total $800 or greater. Direct deposit(s) must be $800 or greater, in aggregate, within 30 consecutive days. Payroll direct deposit(s) must be received to Cash-Back Checking Account within 60 days of account opening. New accounts screened through ChexSystems. $10 minimum opening deposit required for Membership Savings. $0 minimum balance required to earn dividends on Membership Savings Account. Annual Percentage Yield = 0.10% on Membership Savings Account. Rates effective 7.1.2025 and are subject to change without notice. Fees could reduce earnings. Earn 5¢ cash back on PIN-based debit card purchases and 10¢ cash back on signature-based debit card purchases. Cash back deposited monthly to Membership Savings Account. Promotional deposit(s) will be deducted if account closed less than 180 days after opening the account. Member is responsible for any taxes. Person must have US SSN/ITIN to receive promotion. One per SSN/ITIN. Program subject to change without notice. Cannot be combined with any other offer. A+FCU employees, volunteers, and their families are excluded from the program. Excludes Fiduciary, Association, Guardianship, Trust, Business, and Estate accounts. Not valid for existing or previous members. One per household. Must present coupon and/or promo code at time of account opening. Expires 12.31.2025.

**Early payment of funds is not guaranteed and is subject to when A+FCU receives the funds from the originator.