Having A Baby

With each addition to the family, expectant or new parents must consider how to adapt to changing finances. Use our resources to help you plan as you review benefits, budgets, and more.

Steps To Take Before Having A Baby

Planning for a baby can be an exciting and busy time for families. Follow these steps to get prepared before baby arrives.

Do Your Research

Before trying to conceive or adopting, review your healthcare options to ensure you’re adequately covered. Both you and your partner should reach out to your human resources department and take advantage of open enrollment to sign up for the right coverage if applicable.

If you are or hope to get pregnant, take a look at your healthcare benefits to find out what tests, appointments, screenings, etc. are covered under your plan. You may also ask your human resources department or benefits provider if they can help you better understand your coverage.

Questions to research:

- What does your healthcare plan cover? Is there a copay or a deductible?

- Is your doctor in- or out-of-network?

- Do you have to pay per appointment or a flat fee? If there’s a deductible, what percentage of the costs are covered once you meet it?

- Does your plan have an out-of-pocket maximum?

If you’re employed, talk with your benefits provider about your company’s family leave policy. Some may offer paid time while others may not.

Under the Family and Medical Leave Act (FMLA), most employees are eligible for up to twelve weeks of unpaid time for birth or adoption.

You’ll also want to ask about using sick time and/or vacation days. Additionally, you may be able to use Short-Term Disability coverage for your time off after birth or adoption.

Now that you’re going to add a dependent, you’ll want to make sure your child, partner, and/or loved ones are taken care of if something should happen to you. Life insurance can act as a replacement income for your family.

First, check with your employer to see if they offer life insurance, find out the cost, and determine if it’s enough to meet your family’s needs. If it’s not an option or doesn’t meet your needs, seek life insurance elsewhere.

In Texas, a two-income household can expect to pay about 10-12% of their income on center-based childcare. Single parents pay a much higher percentage of their income on childcare.

Begin researching childcare options and costs if you and/or your partner are planning to return to work after welcoming your little one. Start asking for recommendations, reading up on different facilities, and calling for prices.

Options to research:

- Relative

- In-home daycare

- Daycare center

- Live-in nanny/part-time nanny

You’ll need to select the option that works for you. You may find that a combination of the above options works best.

Finances

Do you have a budget? When did you last review your budget? Before bringing your child home, track and review your expenses to build a budget.

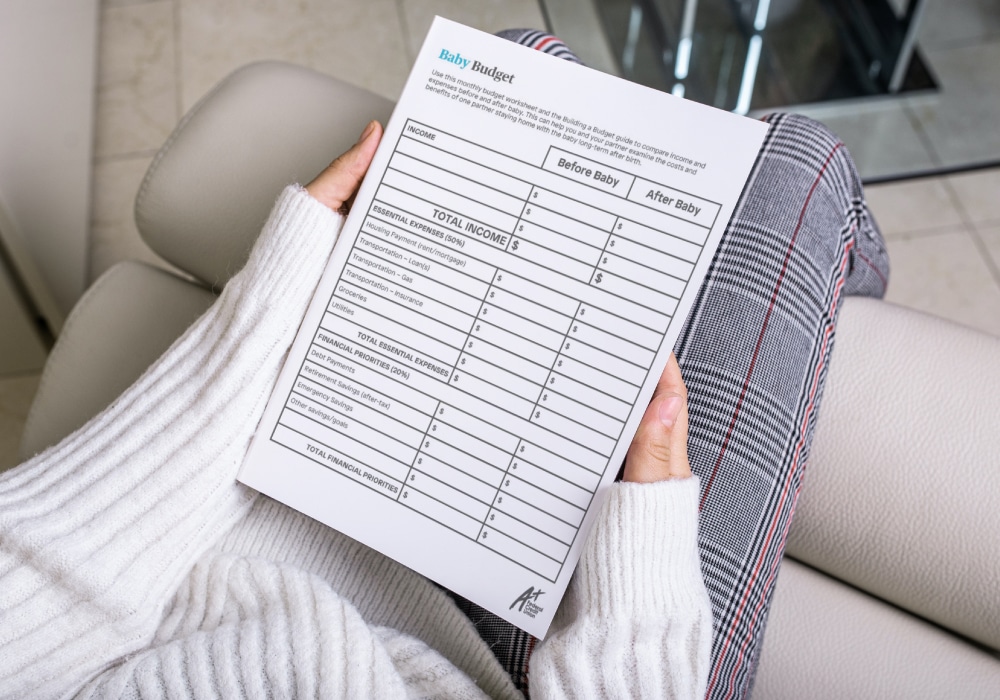

Baby Budget Worksheet

Use this free budget worksheet to compare income and expenses before and after baby. This worksheet can also help you and your partner examine the costs and benefits of one partner staying home long term.

Income

If you expect financial support from a partner, talk to them about your income situation after welcoming your child. Will you have income from a job during the family leave period? Will you or your partner stay home full time? Will either of you reduce your hours or work from home? How will these changes influence your household income?

If staying home, it can help save on childcare costs, but it’ll also reduce your household income. It could also affect Social Security and other retirement benefits in the long run. It’s a decision you and your partner need to carefully consider.

Expenses

Know that your spending is going to change. You’ll need to adjust your budget to cover these new, ongoing expenses.

On average, it costs new parents $12,000 the first year – this includes furniture, housing, supplies, etc. However, costs will vary depending on where you live as well as the choices you make – like using cloth diapers or breastfeeding if able to.

| Ongoing Costs | Average Monthly Cost |

|---|---|

| Childcare | $800 – $1,000 |

| Formula | $60 – $120 |

| Clothing | $60 |

| Food | $50 – $100 |

| Diapers | $30 – $85 |

| Toys/Books/Entertainment | $20 – $40 |

As you evaluate and build your post-baby budget, consider using the months leading up to see what works and what doesn’t. For example, if you’re a two-income household and one person will be staying home, try living on one income to work through the changes needed. Use the second income to pay down debts and save for upcoming costs.

Hidden Costs Of Having A Baby

There are the obvious costs like diapers, food, and clothing, but are there other costs that you may or may not know about? Here’s a list of hidden costs that can help you budget your dollars and prepare for the arrival of your new bundle of joy.

Debt & Savings

Debt

One of the benefits of creating a budget is finding extra money to pay down debt. If you have debt, start to pay down your high-interest debt as quickly as possible. After paying off your debt, you can use the money you were making in payments to take care of the added costs of having a child.

Save

Another benefit of a budget is making a plan to set aside money for savings. Ideally, you should have an emergency savings that covers 3-6 months’ worth of expenses.

But with a new addition, your goal should be to have at least 6 months’ worth of expenses set aside in an emergency fund. This will help keep you from accruing or getting further into debt if a financial emergency occurs.

Debt

To get out of debt, you need to be intentional with your money. Reach your goals faster with our tools for evaluating your debt load, developing a repayment strategy, and staying committed.

Steps To Take After

Bringing your child home can be an exciting and busy time for families. Follow these financial steps once settled.

Get A Social Security Number

If you’re welcoming a baby at a hospital, the easiest way to get a Social Security number for them is to apply when you provide information for their birth certificate. If you apply at a Social Security office, there may be delays while they verify your child’s birth certificate.

A Social Security number is necessary in order to claim them as a dependent on your taxes and qualify for various tax benefits. It’s also needed to get medical coverage for your child and if you plan to open a savings account for them.

Update Your Health Insurance

Be sure to check with your health plan provider to find out the rules and details you’ll need to follow to make changes to your health insurance. If you wait too long and miss the deadline, you may have to wait until open enrollment to add them.

Set Up Or Update Your Will

If you don’t have a will, now’s the time to get one set up. There are several resources and programs online that can assist in writing your will or you can consult an expert.

You may also want to check with your employer to see if they offer discounts or have a partnership with a company that can help – possibly through an Employee Assistance Program.

In the will, you’ll want to decide or update who will:

- Inherit your property

- Be executor to handle your estate

- Serve as a guardian for your kid(s)

- Manage property for your kid(s)

Update Beneficiaries Or Designations

In addition to your will, review all of your beneficiary designations to ensure they match up with how you want your assets divided. These include your life insurance, retirement accounts, bank accounts, and others.

While you may have your spouse or partner designated as the primary beneficiary, you may want to add your child as a secondary beneficiary on these documents, or as the primary if no one is designated.

Consider Saving For Your Child’s Future

While it may be tempting to begin saving for your child’s education, you need to make sure you’re contributing and maxing out on your retirement savings first. You also want to make sure you have a healthy emergency fund with at least six months’ worth of expenses.

If you have both of these started and you have room in your budget, begin setting aside money for your child’s education or future. Consider meeting with a financial advisor to discuss special savings accounts for education.

A+ Wealth Management

Put your money to work with the right tools. Create a custom investment strategy with an A+ Wealth Management Financial Advisor.

Can You Afford To Stay Home?

Is one parent planning to stay home? This discussion needs to occur way before the baby arrives.

Planning to live off of one income isn’t something you can adjust to overnight. It requires thought and planning, so take a good, hard look at the numbers to evaluate and justify the pros and cons.

While this isn’t a decision solely based on financial considerations, that’s where our focus will be. Make sure to also discuss with your partner the many other factors when you’re deciding what’s best for your family.

Considerations

When a parent decides to stay home, that can sometimes mean leaving a job and the income that comes with it. Look at the numbers; it’s best to first determine how much the total income loss will be.

If you’re unable to live on one income, there are several options available to you to bring in extra income – such as taking part-time or freelance work, getting paid to take surveys, delivering groceries, etc. The plus side of many of these options is that you can make your own schedule.

Next, you’ll need to evaluate your expenses to make sure they don’t exceed your income.

Your first step is to get an accurate picture of everything you’re currently spending money on. This includes your housing, groceries, clothing, transportation, etc. Make a list of everything and then track your expenses for 1-2 months to verify your estimates.

Once you have all your expenses, identify the ones that will remain the same no matter if a parent stays home or continues working. For example, your mortgage or rent payment is likely to stay the same.

Now that you know where your money’s going, it’s time to examine how your expenses are going to change once you welcome the newest family member.

If you’re the parent who decides to stay home, you’ll need to think about how your expenses will change. While certain expenses will decrease, some will go up. You’ll also have to look at the long-term costs of not being employed.

Expenses That Could Decrease/Disappear:

- Childcare: the need to pay for regular childcare disappears. This isn’t to say that you’ll never need a babysitter, but rather you won’t have to worry about paying thousands every month.

- Transportation: one less person commuting to work could equal savings in gas, repairs, and insurance. If the car is no longer being used to commute, call your insurance company to see if your rate will go down. Another possibility is going down to one vehicle to save even more.

- Work-Related: there may no longer be the same work-related expenses that existed before – things like going out to lunch regularly, buying work clothes, picking up food on the way home, etc. You may still have these expenses, but they’ll likely decrease.

- Taxes: one less income may push you into a lower tax bracket, which could reduce your overall tax liability.

Expenses That Could Increase:

- Utilities: staying at home during the day means the air conditioner/heat will run regularly throughout the day. You’ll also use water and electricity more frequently.

- Groceries: eating and cooking at home more means paying extra for groceries, but this will likely lead to lower dining out expenses.

- Child-Related: you now have another person in your household that requires additional food, clothing, and items to survive. Things like diapers, formula, clothing, and more are all new expenses that you might need to add into your new budget.

In addition to the current impact, you and your partner need to consider the long-term costs, benefits, and consequences.

- Retirement: not working for a long period of time can have a significant impact on your ability to save money for retirement. Without a job, you’re no longer eligible for an employer-sponsored retirement account or any employer contributions that may have come with it. You’ll also need to be aware of how many credits you’ve earned in order to qualify for Social Security benefits.

- Employability: if the parent staying home does eventually plan to go back to work, you’ll also need to consider the potential loss in employability when returning to the job market. Many parents re-entering the workforce have to start at a lower paying job or even in a different industry than where they were before.

- Divorce: while no one wants to think that they’ll get divorced, it does happen. If it does, the partner that stayed home with the kid(s) may have it much harder financially.

Putting It Together

Once you’ve looked at how income and expenses will change, you need to see if the numbers match up on paper and in real life. On paper, can you make it work? Are you able to pay all your bills, expenses, savings, debt, etc. on one income?

If it looks alright on paper, put it into action. Try to live on one income for as many months as possible before the big day.

Try to save the entire paycheck of the partner who’s considering staying home in your emergency savings account or use it to reduce debt. Then use the remaining paycheck for all living expenses. See what works and what doesn’t and make adjustments as needed.

Whether you live on one income or two, it’s important to factor in the increased expenses that come with having a child and make sure you have enough cushion in your budget to accommodate them.

Living on one income, whether you have help or not, isn’t impossible. However, it does require planning and discipline.

Resources

Get on the path to financial success with these resources.

Related Articles

Practical Money Tips Your 5-Year-Old Will Understand

Introduce simple financial concepts early on to help your child become more capable with money as they mature.

5 Best Savings Tips Kids Need To Know Now

Teaching a child the importance of saving at a young age is an essential life lesson to benefit their future.

Personal Finance Topics All High School Students Should Know

Help teenagers prepare for the real world by teaching them these critical finance topics.

Join The A+FCU Family

Joining is easy and comes not only with a wide variety of money-saving products tailored to fit your needs, but also exclusive member-only benefits.