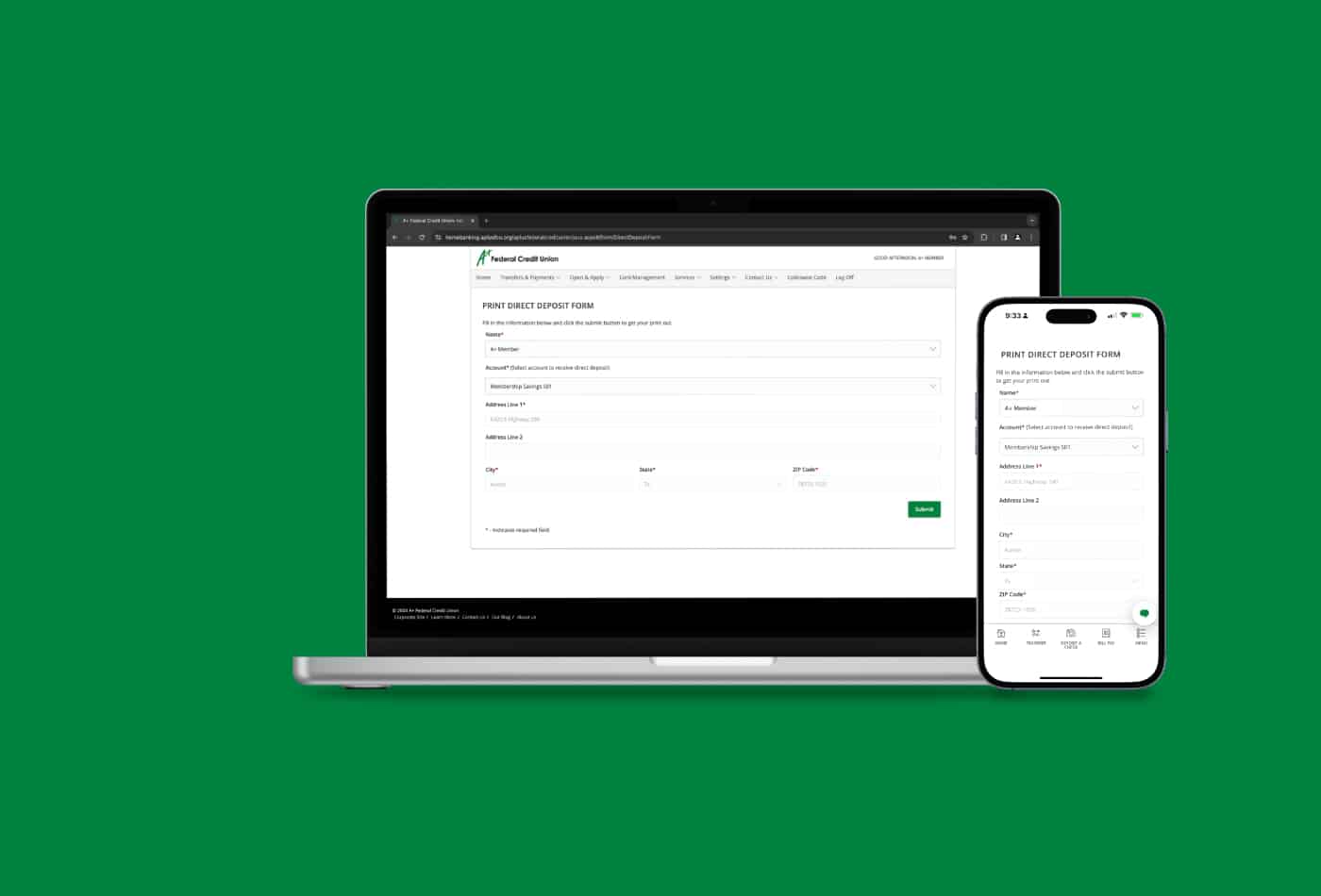

A+ Federal Credit Union

Get the most out of your savings.

Invest in your future by opening one of our low-risk, high-yield certificates and watch your savings grow. These are great investments with predictable, reliable returns, and with multiple options to choose from, reaching your financial goals will be easier than ever.

Find out about…

Banking on each other. Building stronger communities.®

At A+FCU, we don’t have customers, we have members. That means we’re all in this together, and when one member does well, we all share the benefits.

We’ll set you up with the right account for your needs.

Manage your money to best fit your needs. Enjoy a variety of account options when it comes to your spending, saving, and planning.

Latest Articles

4 Pitfalls To Avoid With Kids

Do you know what message you’re unintentionally sending to your kids about money? Find out which four money behaviors commonly give the wrong impression.

When Is It Appropriate To Open A Child’s First Checking Account?

Deciding when to open a child’s first checking account can be a difficult decision. Here are some considerations and tips to help make it a little easier.

Practical Money Tips Your 5-Year-Old Will Understand

Introduce simple financial concepts early on to help your child become more capable with money as they mature.